Resilient industrial specialists in a disruptive age

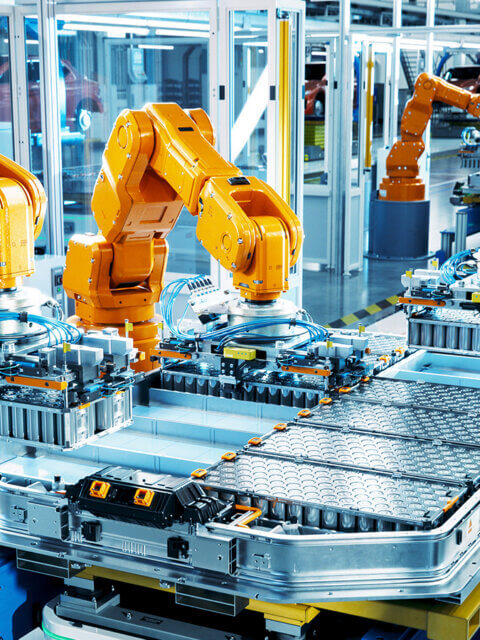

Suppliers of niche but critical components look well positioned to navigate the next industrial cycle

Showcasing Impax’s original thinking on the challenges and opportunities arising from the transition to a more sustainable economy.

Suppliers of niche but critical components look well positioned to navigate the next industrial cycle

Our engagements have identified robust AI governance structures and processes whose adoption could help mitigate financially material AI-related risks

We believe analysis of the powerful, long-term secular forces driving the transition to a more sustainable economy enables equities investors to exploit short-term market inefficiencies

Early successes show AI’s capacity to improve the efficiency of drug discovery and hospital workflows, lowering healthcare system costs and enhancing access to treatments

US tariffs on metal imports have led to indiscriminate repricing of bonds, creating pockets of value among non-US issuers in the sector

Ageing and leaky water systems are in urgent need of an upgrade, presenting opportunities for innovative solution providers and utilities alike

The US government’s action to shift the national diet towards nutrient-rich foods provides tailwinds for companies in ‘real food’ supply chains and reformulation

Despite rising bond issuance, the global high yield market continues to be supported by the economic context, elevated yields and strong corporate fundamentals

Looking into 2026, we share perspectives from our Listed Equities, Fixed Income and Private Markets teams.

Impax’s analysis of key sustainability-related themes disrupting the Financials sector and their impact across a set of sub-industries

The overdue reassessment of unhelpful terms and acronyms is vital to re-establishing the boundary between investment and values, and to help ensure investors understand long-term risks and opportunities

The structural shift in consumer spending towards services and experiences, and increasingly from in-person to online, supports the durable growth of innovative leaders in digital services

Elevated manufacturing construction, trade policy and favourable tax rule changes all support an improving credit outlook for North America-focused industrials

Our quantitative analysis of open-source employee reviews reveals material correlations with stock performance that contribute to the Impax Corporate Culture Indicator framework

The collapse of First Brands and Tricolor exposes deep cracks within private credit that could yet ripple out, but high yield credit market fundamentals remain robust

Julie Gorte reflects on the false narratives and politicization surrounding sustainable investment approaches, and the financial costs of overlooking environmental and social risks

Measuring impact from environmental and social investment opportunities

The interest rate swap curve is an alternative reference point for pricing corporate bonds at a time when US government debt’s historic ‘risk-free’ rate status looks shaky

Sustained adoption of electric vehicles in Europe supports selective opportunities for private markets investors in charging assets.