We believe:

- Capital markets will be shaped profoundly by global sustainability challenges, particularly climate change, environmental pollution, natural resource constraints, demographic and human capital issues such as diversity, inclusion and gender equity.

- These trends will drive growth for well-positioned companies and create risks for those unable or unwilling to adapt.

- Fundamental analysis which incorporates long-term risks, including environmental, social and governance (ESG) factors, enhances investment decisions.

We invest

- In companies and assets that we believe are well positioned to benefit from the transition to a more sustainable economy.

- In companies that we believe are higher quality, with strong business models and governance, that demonstrate sound management of risk whilst being able to adapt intelligently to changing conditions.

We offer:

- A well-rounded suite of investment solutions spanning multiple asset classes, aiming to deliver superior risk-adjusted returns over the medium to long term.

- Investment solutions underpinned by proprietary investment tools designed to allocate clients’ capital towards the sustainable economy.

How does the transition to a more sustainable economy create investment opportunities?

This summary document explains how global sustainability challenges are profoundly shaping capital markets, provides examples of disruptive forces that are driving change, and investable opportunities that benefit from that change.

Date: 30 Sept 2023

How does the transition to a more sustainable economy create investment opportunities?

This summary document explains how global sustainability challenges are profoundly shaping capital markets, provides examples of disruptive forces that are driving change, and investable opportunities that benefit from that change.

Date: 30 Sept 2023

Impax 25 years – the transition to a more sustainable economy

Insights

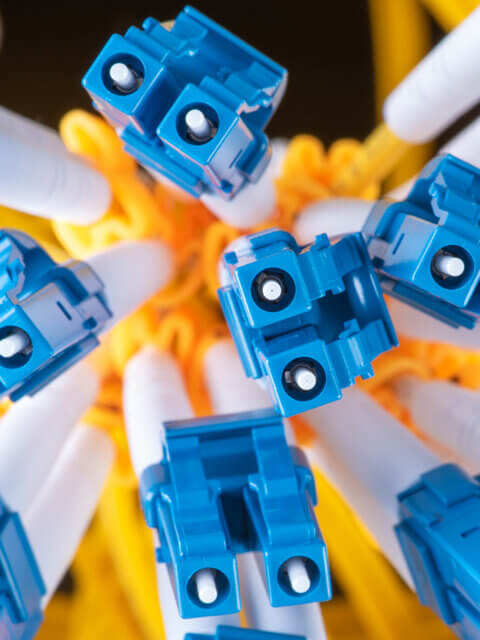

Small-cap enablers of advanced digital infrastructure

The US technology sector may be synonymous with ‘Big Tech’, but we see underappreciated growth opportunities among smaller companies plugged into the digitalisation trend

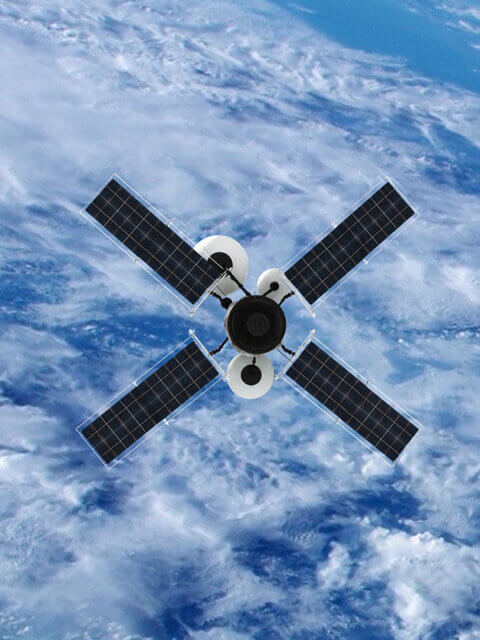

Orbit disruption: credit opportunities in the satellite market

Starlink’s ascent to dominate consumer satellite broadband has de-rated sector debt, but many incumbents remain competitive in growing niches of satellite communications

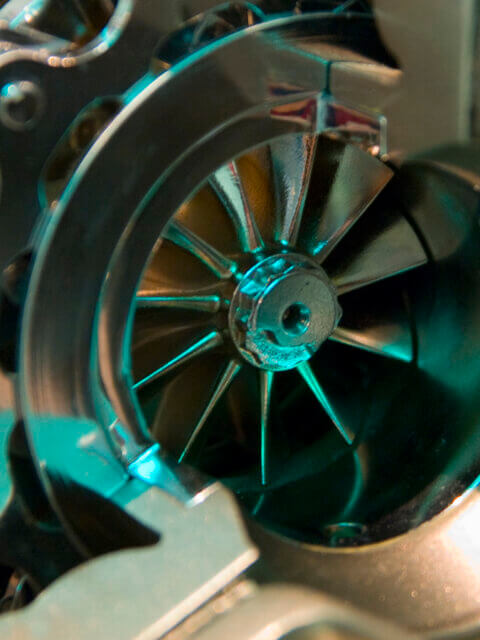

Autonomous driving technologies gain traction

Chinese carmakers are leading the integration of advanced driver-assistance systems, promising to reinvigorate the shift towards vehicle electrification

Overcoming obstacles to grid decarbonisation in Europe

Far-sighted policies are needed to address barriers to infrastructure investment and to unlock the capital to transform the region’s power system

EM corporate bonds: Could Trump’s tariffs create opportunities?

While emerging markets corporates must navigate the uncertainty of tariffs, the heightened unpredictability and greater volatility creates more market dislocations, enhancing the potential for alpha generation.

Addressing the hidden water footprint of data

Innovative technologies can help data centre operators reduce their water-related dependencies, creating opportunities for investors amid rising demand for a finite resource

United States

United States