Emerging market (EM) corporate bonds are on the frontline of the tariff war that has characterised Donald Trump’s second term so far. However, we believe companies across these economies are entering this period of uncertainty in relatively robust health.

In the context of heightened volatility, where asset values can become detached from security-specific fundamentals, we identify pockets of opportunity among EM issuers that can navigate tariffs, either through weaker local currency or US production, and that are unaffected by pressures facing sovereign debt.

Facing uncertainty from a place of strength

The average bond in the Corporate Emerging Markets Bond Index (CEMBI) carries a ‘BBB’ rating, and credit quality across the index continues to strengthen with the ratio of upgrades to downgrades recently reaching its highest level in a decade.1

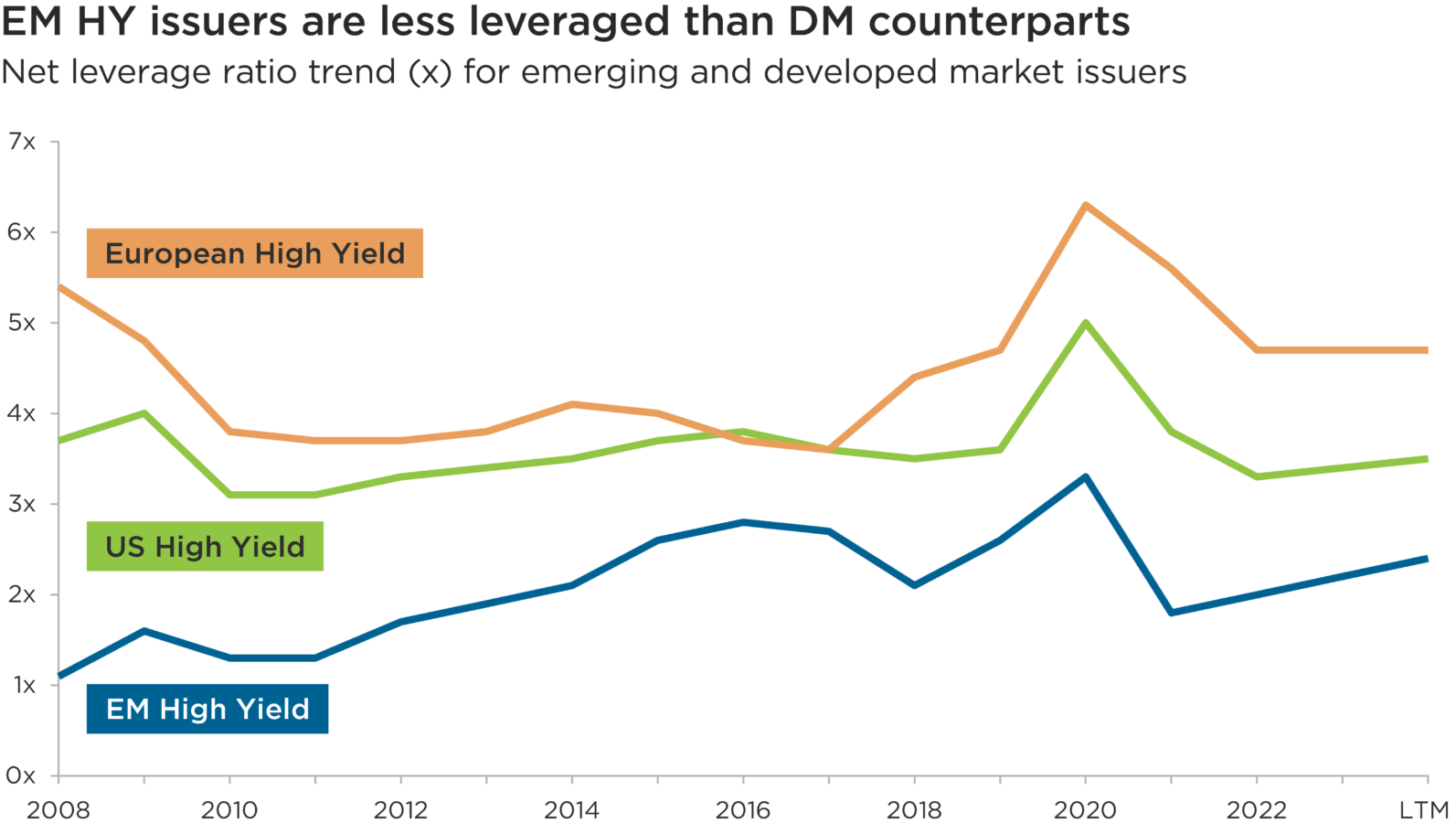

Credit metrics for EM high yield bonds remain within historical ranges and are significantly better than their developed market (DM) counterparts in the US and Europe. As shown below, EM high yield issuers have lower net leverage than their US and European equivalents, while maintaining strong interest-coverage ratios, supporting their ability to meet debt obligations.2

Source: JP Morgan, 2024. Pending availability of complete information for 2024, the most recent data available for a 12-month period (LTM) is included instead.

Subhead: Net leverage ratio trend (x) for emerging and developed market issuers

Overview: This chart how the level of borrowing held by emerging markets corporates relative to their US and European counterparts between 2008 and 2024.

The impact of macroeconomic risks on EM companies varies according to a range of factors such as sector, product mix, and customer base. Navigating tariffs, credit risks, and country-specific risks, among other challenges, does not necessarily diminish the appeal of EM corporate bonds. In fact, the increasing complexity is welcomed by credit investors who are strongly focused on security selection and relative value.

As the opportunity set of undervalued bonds evolves more rapidly during periods of heightened unpredictability, greater volatility creates more market dislocations and enhances the potential for alpha generation.

China and Mexico’s trump card

It came as no surprise to us that Mexican and Chinese goods were the main targets of Trump’s tariffs. Over the last decade, the evolving trade relationship between the US and China has encouraged Chinese corporate managers to devise strategic solutions to mitigate the impact of tariffs. Mexico has emerged as one of several new markets for China, providing opportunities to access the US or expand into other countries.

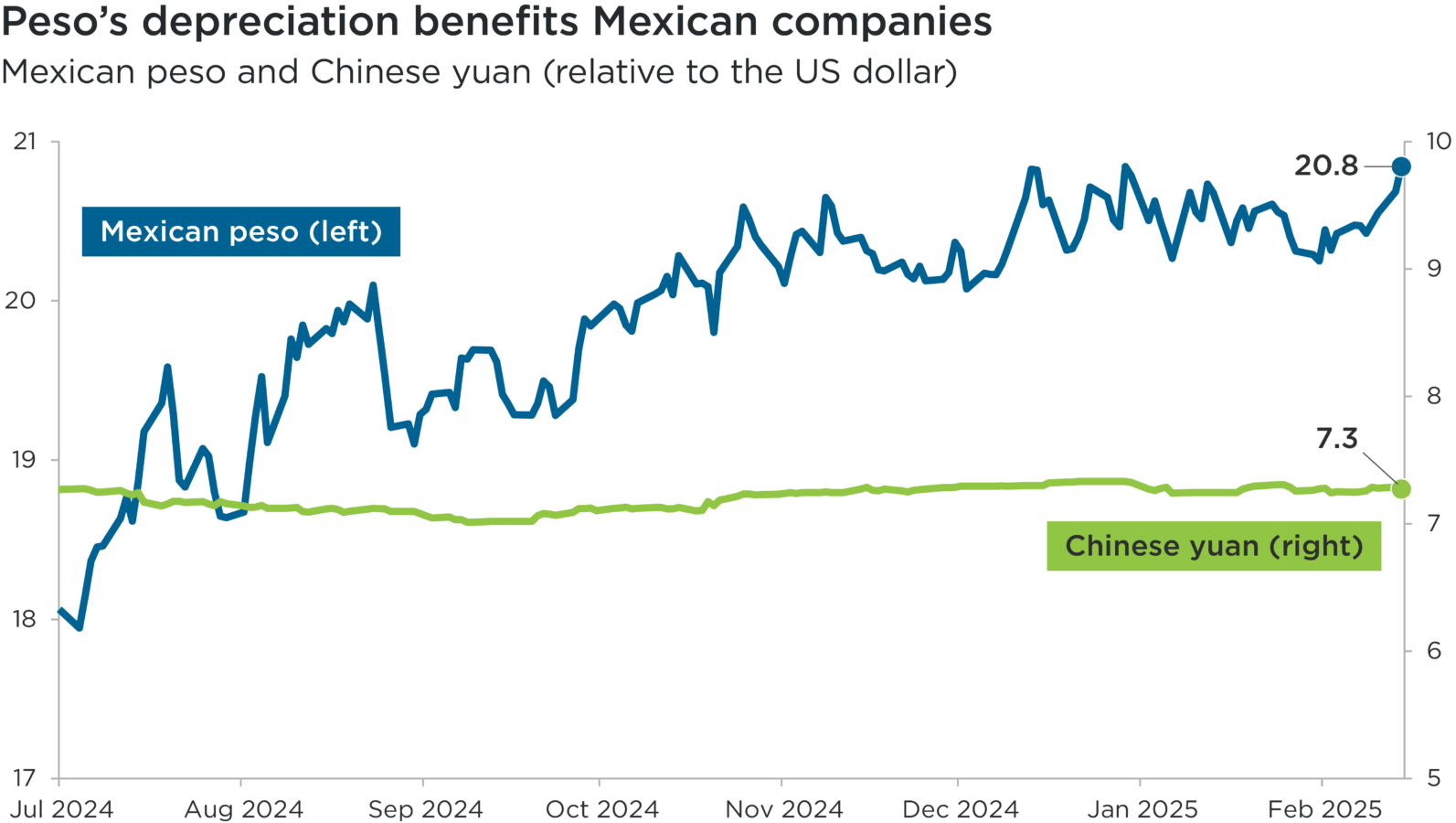

Currency depreciation is one way to mitigate the impact of US tariffs. While the People’s Bank of China has kept the yuan relatively stable against the US dollar, the peso has depreciated by more than 15% since Trump’s nomination.3 This creates an advantage for Mexican companies by making exports to the US more cost competitive.

Source: Bloomberg, March 2025. Data from 19 July 2024 to 4 March 2025.

Subhead: Mexican peso and Chinese yuan (relative to the US dollar)

Overview: This chart shows the changing values of the Mexican peso and the Chinese yuan against the US dollar over the six months to end February 2025.

Y axis (rhs): Chinese Yuan

Y axis (lhs): Mexican Peso

Additionally, it is important to consider the manufacturing labour costs differences between the US, China and Mexico. US wages are nearly three times higher than in China, and six times higher than in Mexico.4 Given this wage advantage – along with the cost of moving production and other factors – it is not certain that increasing tariffs will encourage the reshoring of labour-intensive manufacturing to the US.

Navigating the asset class in volatile times

The decreased market predictability for risky assets that has been evident since the start of Trump’s second term has given rise to fluctuations in US rates (MOVE), equities (VIX), and US credits (VIXHY).5 However, this volatility is likely to drive new opportunities among EM corporate bonds as the sensitivity of companies to tariffs varies across countries, sectors and global footprints.

As corporate bond investors, we expect to find attractive investment opportunities where asset valuations become unmoored from corporate fundamentals in countries facing increasing macroeconomic risks.

We see the strongest potential for attractive risk-adjusted returns among the following types of companies:

First, exporting companies. We are carefully analysing companies’ ability to either pass through tariff costs to customers or mitigate their impact. Historically, local currencies tend to weaken during periods of elevated macroeconomic risk.

Second, companies with US production facilities. The trade wars of Trump’s first term demonstrated to EM companies the benefits of having US production facilities closer to US-based customers, to mitigate the risk of tariffs.

Third, credit rating changes on EM sovereign debt. Depending on the outcome of tariffs and their spillover effects on economic growth, the fiscal balance and foreign direct investments, EM sovereign debt may face increasing rating pressure. This could potentially trigger downgrades among corporate bonds that are closely linked to sovereign ratings. Such downgrades may not be merited by company fundamentals, however.

Conclusion

Today, the EM corporate bond market consists of companies that are well diversified across regions, countries and sectors. Careful corporate due diligence allows fixed income investors to assess the extent to which they are being compensated for firm-specific risks, with tariffs being one of many factors to consider.

By managing EM tariff risk on a security-specific basis, we believe investors are presented with compelling opportunities to access the strong risk-adjusted return potential of this asset class.

1 JP Morgan, December 2024

2 JP Morgan, December 2024

3 Bloomberg, March 2025

4 Morgan Stanley Research, November 2024.

5 Bloomberg, March 2025

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States