Source: International Energy Agency (IEA)

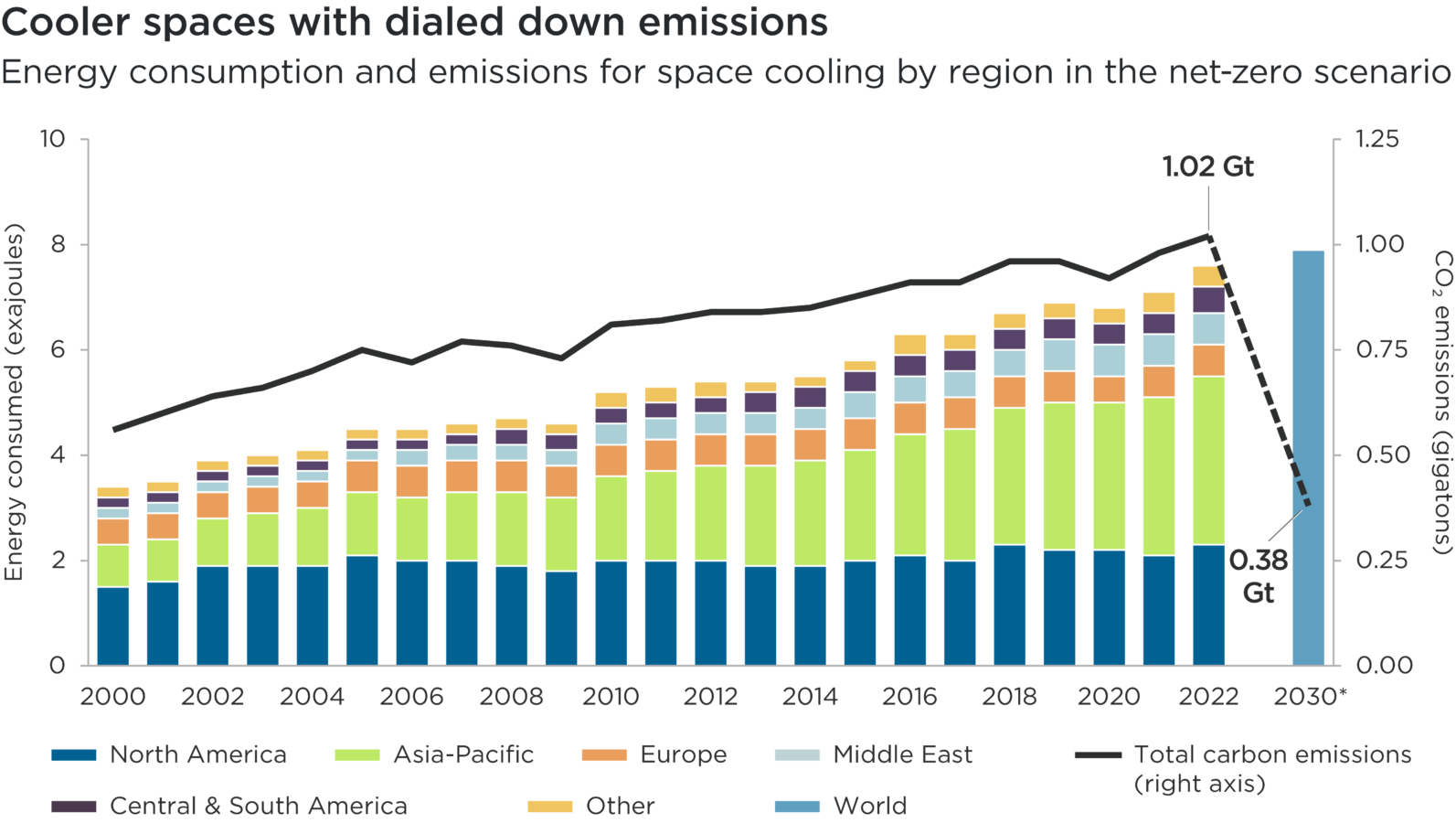

The bar and line chart shows carbon emissions (in gigatons) and electricity demand (in exajoules) by region for space cooling in the IEA 2030 net-zero scenario (2000-2030).

Regions include North America, Asia-Pacific, Europe, Middle East, Central and South America and Other. The chart shows that, in a scenario outlined by the IEA, indirect CO2 emissions from space cooling fall to around 40% of today’s level by 2030, even as global consumption of energy for space cooling rises continues to rise gradually.

Cooler spaces, lower emissions

| Year | North America | Central and South America | Europe | Asia Pacific | Middle East | Other | World | Total carbon emissions |

| 2000 | 1.5 | 0.2 | 0.5 | 0.8 | 0.2 | 0.2 | 0.56 | |

| 2001 | 1.6 | 0.2 | 0.5 | 0.8 | 0.2 | 0.2 | 0.6 | |

| 2002 | 1.9 | 0.2 | 0.5 | 0.9 | 0.2 | 0.2 | 0.64 | |

| 2003 | 1.9 | 0.2 | 0.5 | 1 | 0.2 | 0.2 | 0.66 | |

| 2004 | 1.9 | 0.2 | 0.5 | 1.1 | 0.2 | 0.2 | 0.7 | |

| 2005 | 2.1 | 0.2 | 0.6 | 1.2 | 0.2 | 0.2 | 0.75 | |

| 2006 | 2 | 0.2 | 0.6 | 1.2 | 0.3 | 0.2 | 0.72 | |

| 2007 | 2 | 0.2 | 0.6 | 1.3 | 0.3 | 0.2 | 0.77 | |

| 2008 | 1.9 | 0.3 | 0.6 | 1.4 | 0.3 | 0.2 | 0.76 | |

| 2009 | 1.8 | 0.3 | 0.6 | 1.4 | 0.3 | 0.2 | 0.73 | |

| 2010 | 2 | 0.3 | 0.6 | 1.6 | 0.4 | 0.3 | 0.81 | |

| 2011 | 2 | 0.3 | 0.6 | 1.7 | 0.4 | 0.3 | 0.82 | |

| 2012 | 2 | 0.3 | 0.6 | 1.8 | 0.4 | 0.3 | 0.84 | |

| 2013 | 1.9 | 0.4 | 0.6 | 1.9 | 0.4 | 0.2 | 0.84 | |

| 2014 | 1.9 | 0.4 | 0.6 | 2 | 0.4 | 0.2 | 0.85 | |

| 2015 | 2 | 0.4 | 0.6 | 2.1 | 0.5 | 0.2 | 0.88 | |

| 2016 | 2.1 | 0.4 | 0.6 | 2.3 | 0.5 | 0.4 | 0.91 | |

| 2017 | 2 | 0.4 | 0.6 | 2.5 | 0.5 | 0.3 | 0.91 | |

| 2018 | 2.3 | 0.4 | 0.6 | 2.6 | 0.5 | 0.3 | 0.96 | |

| 2019 | 2.2 | 0.4 | 0.6 | 2.8 | 0.6 | 0.3 | 0.96 | |

| 2020 | 2.2 | 0.4 | 0.5 | 2.8 | 0.6 | 0.3 | 0.92 | |

| 2021 | 2.1 | 0.4 | 0.6 | 3 | 0.6 | 0.4 | 0.98 | |

| 2022 | 2.3 | 0.5 | 0.6 | 3.2 | 0.6 | 0.4 | 1.02 | |

| 2030 | 7.9 | 0.38 |

Rising temperatures risk undermining economic productivity, especially in hotter, poorer regions most vulnerable to the impacts of extreme heat. By 2030, the International Labour Organization conservatively estimates that 2.2% of total working hours will be lost to high temperatures.1

Air conditioning already plays a critical role in keeping people and their workplaces safe and productive. This role will necessarily expand as part of adaptation to a warming climate characterised by more frequent and widespread periods of extreme heat. But traditional cooling systems are very energy intensive: approximately 44% of the power used by commercial buildings in the US goes to heating, cooling and ventilation.2

In a scenario outlined by the IEA, indirect CO2 emissions from space cooling fall to around 40% of today’s level by 2030. The emissions intensity of each air conditioning unit has declined over the last decade, but reductions need to be three times faster to reach the 2030 targets. Without efficiencies, electricity demand from cooling is forecast to triple by 2050 – amplifying the risks that local grids are overwhelmed as the mercury rises.3 While the grids themselves must become less emissions intensive, the industry must also use less energy not only to address higher demand, but also to manage its significant emissions as communities and companies work toward climate resilience.

Technological advances demonstrate that space cooling can be more energy-efficient, however, and so better align the built environment with a low-emission, climate-resilient economy as the world’s cooled floor area doubles by mid-century.

Since 2020, Carrier Global’s high-efficiency and lower-emissions refrigerant products have enabled its customers to avoid more than 212mn metric tons of GHG emissions, equivalent to the annual energy use of nearly 27mn US homes.4 Carrier and Trane Technologies, another company in the space, are each aiming to avoid up to 1 Gigaton of emissions in their customers’ carbon footprint by 2030 through electrification, more efficient systems that leverage technology and data, and further adoption of refrigerants with ultra-low global warming potential.

Three complementary technologies can deliver further efficiencies for buildings owners looking to manage energy costs and reduce emissions. First, heat pumps can operate in reverse and transfer warm air from inside buildings to the outside, using far less electricity than traditional HVAC systems.5 Second, heat recovery systems can meanwhile enable customers to use the heat removed from indoor air to warm water, or store it in thermal batteries (called chiller plants), for later use.6 Third, automated systems use sensors to determine whether a space is being used, enabling specific rooms to be lit, heated and cooled on demand. A hospital, for example, could revamp its surgeries to have energy supplied on demand without overhauling the whole building’s HVAC system.

Demand for air conditioning is expected to rise dramatically in regions most exposed to the effects of climate change: the IEA expects India’s installed air conditioning inventory, for example, to grow 23-fold between 2020 and 2050.7 Rising demand for cooling in a warming climate will support opportunities for innovative companies whose solutions can help enable the transition to a more sustainable, more efficient model for the built environment.

- International Labor Organization, January 2019: Working on a warmer planet: The effect of heat stress on productivity and decent work. Projections are based on a global temperature rise of 1.5°C by 2100 and on labour force trends. ↩︎

- US General Services Administration – Center for Emerging Building Technologies, July 2023 ↩︎

- Temple, J., September 2020: Air conditioning technology is the great missed opportunity in the fight against climate change. MIT Technology Review ↩︎

- Ibid ↩︎

- Trane Technologies, Tomorrow’s World Today, October 2023: Cooling Our World ↩︎

- Ibid ↩︎

- Sherman, P., Lin, H. et al, August 2022: Projected global demand for air conditioning associated with extreme heat and implications for electricity grids in poorer countries, Energy and Buildings ↩︎

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States