The 20th century saw vast advances in longevity, courtesy of medical innovation and improving living conditions. With global life expectancy rising to 73 years in 2019, up from 67 years in 2000, focus in the 21st century is increasingly shifting to quality of life, particularly in richer economies.1,2

The healthcare continuum has expanded to include affordable solutions that help people take better care of themselves. McKinsey estimates that more than US$450bn was spent on products and services that support nutrition, hygiene and fitness in the US in 2022, and that number is growing at more than 5% annually.3 Opportunities driven by these trends can help contain healthcare costs, save time and boost productivity in three distinct areas.

First, personal care solutions for teeth, ears and eyes can help prevent disease and physical deterioration, particularly in developing economies. Second, self-care – using over the counter (OTC) medications, supplements and monitoring devices – can serve as both a substitute for and a complement to traditional healthcare. Third, movement and fitness can boost both personal wellbeing and productivity at work.

Companies that empower people to invest in their own wellbeing can benefit from each of these trends while enabling better health at a lower cost. We believe that the growth opportunities arising from these long-term secular trends can be underestimated by the market.

Improving wellbeing through personal care solutions

Poor oral hygiene, ear care and eye care can each undermine health and quality of life. Simple solutions to these pressing needs can yield impressive dividends in wellbeing and prevent avoidable health issues.

1. Oral care

Over US$45 billion in global productivity is lost each year due to untreated dental disease, which afflicts more than half the world’s population.4 Three in four sufferers live in low and middle-income countries, but the problem is global.5 In the US, an average of 34mn school hours and 92mn work hours are lost each year for unplanned dental care.6 Oral health also has several comorbidities, so improvements in dental hygiene can enable lower incidences of heart disease and diabetes.7

Colgate-Palmolive is a leading provider of toothbrushes, toothpastes and other oral care products across the affordability spectrum. Different price points ensure consumers across income levels have access to products that support healthy habits.8 Colgate’s brand is trusted across the world: it is the only brand bought by more than half of global households.9 The company continues to develop innovative products: in 2022, a Colgate scientist received the prestigious Edison patent prize for developing the first recyclable toothpaste tube.10

2. Eye and ear care

Both vision and hearing loss can cause isolation, depression and cognitive decline. They also pose public health risks, as the incidence of both falling and dangerous driving rises when people lose their hearing or vision.11,12 They affect productivity as well: a recent study estimates that the total global economic cost of hearing loss exceeded US$981 billion in 2019.13 Vision impairment meanwhile reduces annual global productivity by an estimated US$411bn.14

Many factors can contribute to hearing loss, from genetics and noise exposure to medications, head injuries and infections.15 Italian company Amplifon is a leading retailer of hearing aids in 25 countries, both directly to consumers and through franchises and insurance providers. Demand for hearing aids is rising as populations age and as their benefits to wearers are recognised. Adoption remains low, however: the WHO estimates that only 17% of those who would benefit from a hearing aid actually use one. The gap between need and use ranges from 77% in Europe to 90% in Africa.16 Amplifon is working to address this and de-stigmatise the use of hearing aids.

Removing a barrier to care, Amplifon offers interactive apps and virtual care teams that allow consumers to bypass retail stores and test their hearing at home. US regulatory requirements were also lifted in 2022, so that certain hearing aids are now available without a prescription.17

Meanwhile, the causes of vision loss due to cataracts include health conditions and their treatments. Diabetes, steroid medicines (often used to treat arthritis) and radiation treatments are all known risk factors.18 Other drivers of increasing rates of vision loss include ageing populations and excess screen use in a digitalised world.

Companies like Alcon that provide vision correction products and specialised equipment for cataract and retinal surgeries can be part of the solution. Timely access to ophthalmic interventions like cataract surgery can prevent blindness and accidents. Alcon works to make these solutions accessible, especially in developing countries where formal eyecare is typically limited.19

Boosting quality of life through self-care products

Thanks in part to better access to healthcare, life expectancy is increasing around the world, with the gap between developed regions and the rest of the world gradually narrowing.20 Longer lives are not necessarily healthier ones, though. Fortunately for those who suffer from chronic ailments, there are many simple solutions – including medication for low-level pain and digestive issues, for instance – that offer health benefits without a doctor’s visit or prescription.

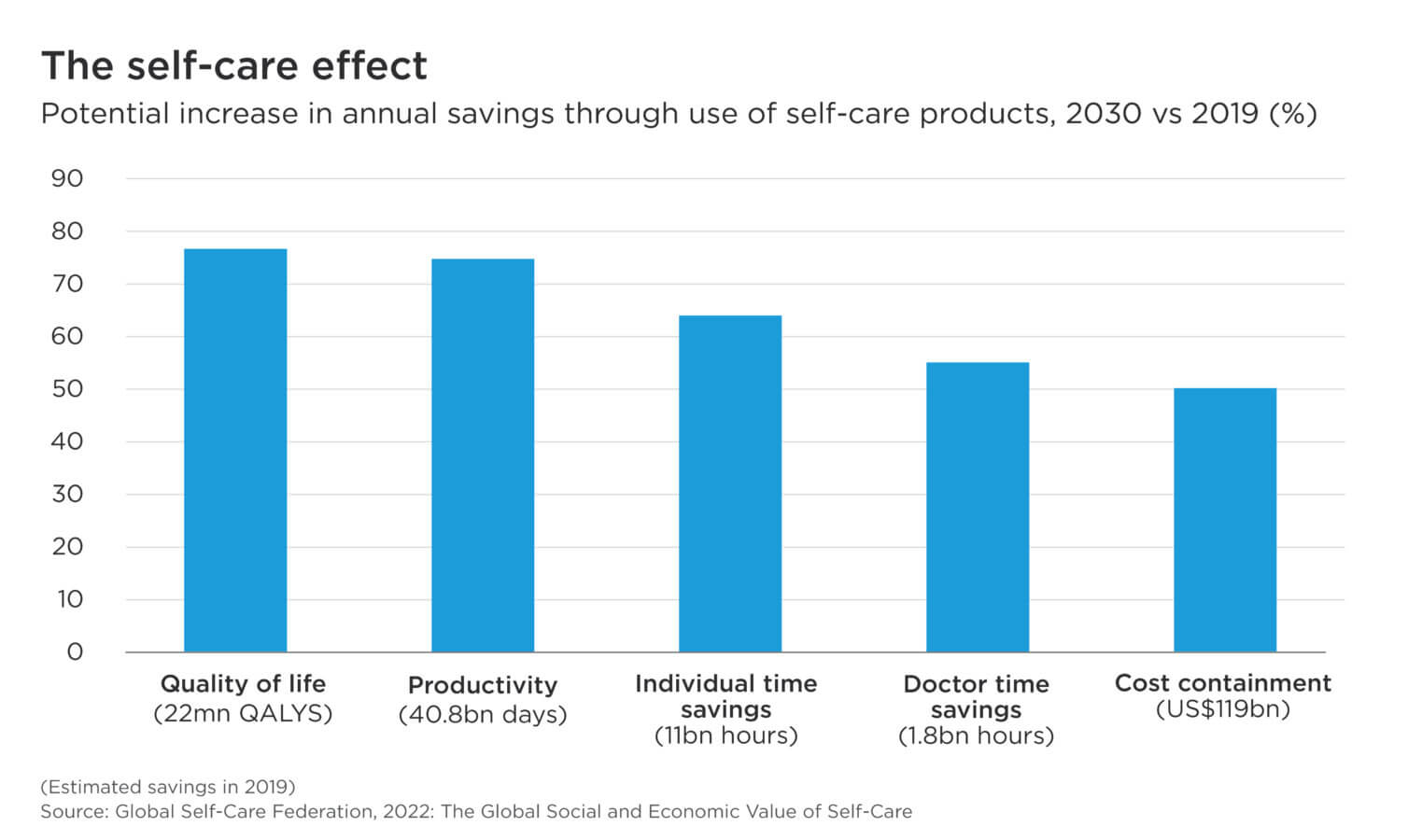

The impact of self-care remedies is extensive. One study estimates that use of self-care products saves 22mn quality-adjusted life years (QALYs) each year, and that these products have the potential to save 39mn QALYs by 2030.21,22

Subhead: Potential increase in annual savings through use of self-care products, 2030 vs 2019 (%)

Overview: The chart shows the potential percentage increase in annual savings that could be achieved with the use of self-care products. The percentage increase is measured from the base numbers in 2019 to potential numbers that could be achieved in 2030.

Source/footnote: The Global Self-Care Federation, 2022: The Global Social and Economic Value of Self-Care

Table:

| Annual savings (2019) | Potential savings (2030) | % increase (decimal) | Potential % savings increase | |

|---|---|---|---|---|

| Cost containment (US$bn) | 119 | 179 | 1.504202 | 50% |

| Doctor time savings (bn hours) | 1.8 | 2.8 | 1.555556 | 56% |

| Individual time savings (bn hours) | 11 | 18 | 1.636364 | 64% |

| Productivity (bn days) | 40.8 | 72 | 1.764706 | 76% |

| Quality of life (QALYS) | 22 | 39 | 1.772727 | 77% |

Preventative self-care measures also help reduce costs for public healthcare systems. A 2022 study found that every US$1 spent on consumer healthcare generates US$7 in future healthcare savings across two major categories: OTC medicines that are more affordable than prescription drugs and avoided doctor visits for minor ailments consumers can treat on their own.23

Haleon – one of the world’s largest makers of OTC medication and vitamin supplements by revenues – aims to improve the wellbeing of 50mn people per year through its products by 2025.24 Many of the company’s offerings help people address minor discomforts and boost their quality of life. Its collaboration with Microsoft supports customers with impaired vision by narrating safety information and labels for many of its products, while its Centrum Silver multivitamins have been shown to support the cognitive function and memory of older adults in recent academic studies.25,26

Reducing health issues through fitness services

Exercise helps people stay healthy, reduces stress and supports immune systems. It can also boost productivity at work by improving sleep, vigour and focus.27

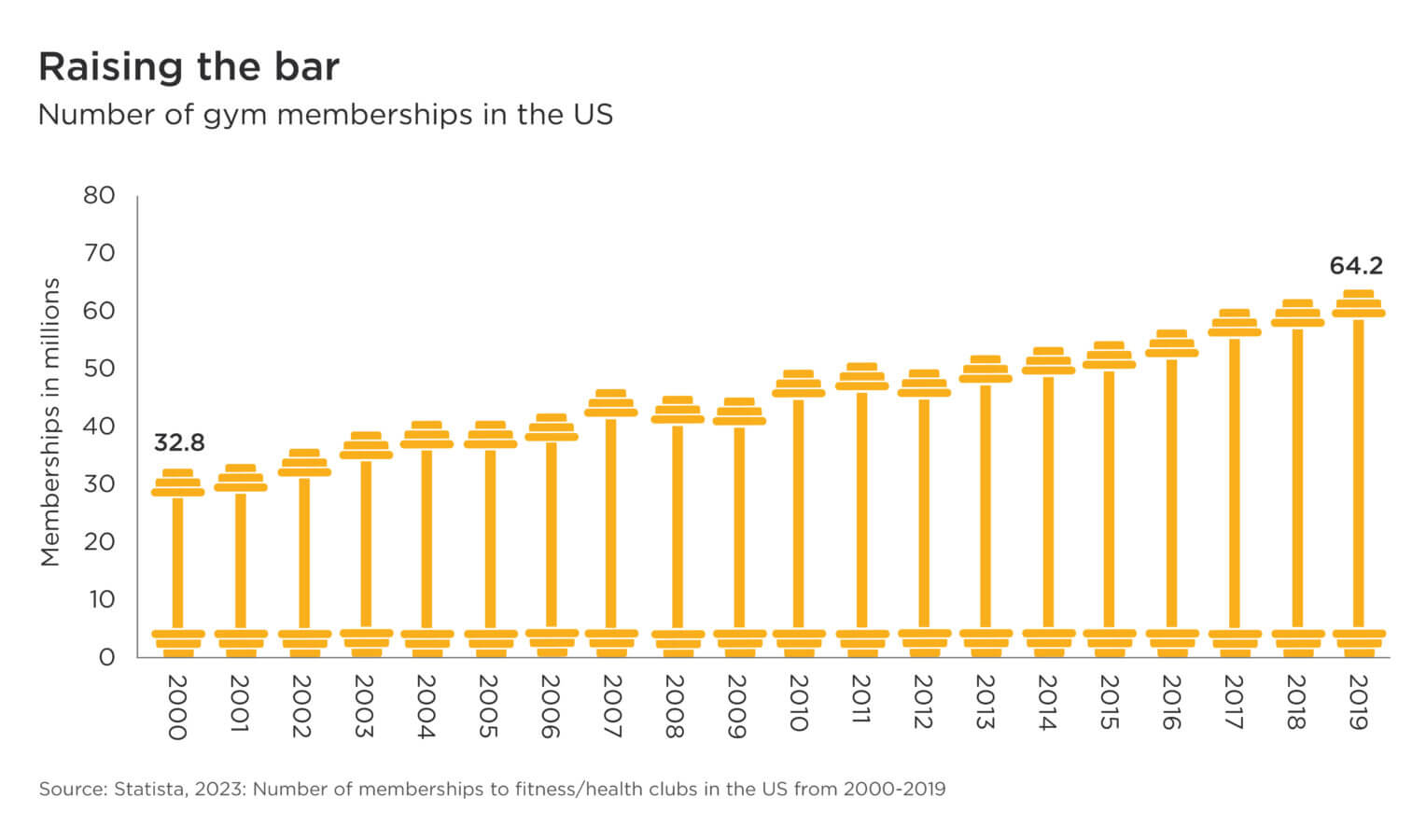

The global fitness industry has sustained long-term growth. In 2020 there were nearly 185mn gym members worldwide, and the US is by far the largest market with just over 64mn – just over a third of the total.28 Gym memberships in the US doubled over the two decades preceding the COVID-19 pandemic, when the industry leveraged digital technologies to pivot towards more online classes.29

Subhead: Number of gym memberships in the US

Overview: The chart shows the number of memberships to fitness/health clubs in the US for each year from 2000 to 2019.

Source/footnote: Statista, 2023

Table:

| Year | Fitness club memberships |

|---|---|

| 2000 | 32.8 |

| 2001 | 33.8 |

| 2002 | 36.3 |

| 2003 | 39.4 |

| 2004 | 41.3 |

| 2005 | 41.3 |

| 2006 | 42.7 |

| 2007 | 46.7 |

| 2008 | 45.6 |

| 2009 | 45.3 |

| 2010 | 50.2 |

| 2011 | 51.4 |

| 2012 | 50.2 |

| 2013 | 52.9 |

| 2014 | 54.1 |

| 2015 | 55.3 |

| 2016 | 57.3 |

| 2017 | 60.9 |

| 2018 | 62.5 |

| 2019 | 64.2 |

Planet Fitness is a leading US gym chain whose services enable people to work out affordably. The company says about 40% of its members had never joined a gym before, and it is focused on expanding access to its 2,400 or so fitness facilities across the US, Canada, Australia and Mexico.30 More than three-quarters of Americans live within 10 miles of a Planet Fitness, and about a quarter of its 17mn members are part of ‘Gen Z’ (under 25s), a demographic that has been characterised as prioritising healthy choices.31 Low membership fees, starting at US$10 per month, and free summer memberships for high school students support broad-based participation.32 Digital tools also serve to expand access, as memberships include an app with home workouts, trainer instruction and progress tracking.33

Supporting the transition to a healthier global society

We anticipate tailwinds for companies with strong exposure to the trend towards greater wellbeing, powered by both top-down structural forces and bottom-up demand.

Cost pressure on healthcare providers incentivises a greater focus on prevention, which we believe will support demand for cost-effective solutions that can address minor issues without prescriptions or appointments.34 At the same time, awareness of and demand for these solutions among consumers has grown.35 Consumers in wealthier countries are finding innovative ways to prioritise fitness and wellness, while consumers in emerging economies have rising disposable income to allocate to better care for their families and themselves.

From hearing aids to toothbrushes, vitamin supplements to low-cost workouts, we believe companies that innovate for and improve access to wellbeing have a clear trajectory for growth as society transitions to a healthier and more sustainable model.

- World Health Organization, 2019: The Global Heath Observatory

- Hambleton, I. and Caixeta, R. et al, 2023: The rising burden of non-communicable diseases in the Americas and the impact of population aging: a secondary analysis of available data, The Lancet Regional Health – Americas

- McKinsey, 2022: Future of Wellness Survey

- Righolt A.J. and Jevdjevic M., et al, 2018: Global-, regional-, and country-level economic impacts of dental diseases in 2015

- World Health Organization, 2022: WHO highlights oral health neglect affecting nearly half of the world’s population

- Centers for Disease Control and Prevention, 2018: Hours Lost to Planned and Unplanned Dental Visits Among US Adults. *Work hours were among adults who had seen a dentist in the previous 6 months

- Centers for Disease Control and Prevention, 2023: Oral Health Conditions

- Donmaz, A. and Sayil, E.M., 2017: The Growth & Importance of Middle Class Consumers in Emerging Markets

- Kantar, 2022: Global Brand Footprint 2022

- Colgate-Palmolive Innovation, 2022: Colgate Recyclable Tube Wins Prestigious Edison Patent Award. *First tube recognized by the Association of Plastic Recyclers

- National Institute on Ageing, 2023: Hearing Loss: A Common Problem for Older Adults

- Cross, J. M. et al. Visual and medical risk factors for motor vehicle collision involvement among older drivers. Br. J. Ophthalmol. 93, 400–404 (2009). Achigbu, E. O. and Fiebai, B., 2013: Visual defects and commercial motorcycle accidents in south eastern Nigeria. Nigerian Journal of Medicine. Subzwari, S. et al., 2008: Effectiveness of cataract surgery in reducing driving-related difficulties: A systematic review and meta-analysis, Injury Prevention vol. 14. Piyasena, P. et al., 2021: Vision impairment and traffic safety outcomes in low-income and middle-income countries: a systematic review and meta-analysis, The Lancet Global Health

- McDaid, D. and Park, A.L;, et al, 2021: Estimating the global costs of hearing loss, International Journal of Audiology.

- World Health Organization, 2023: Blindness and vision impairment. US dollar figure in purchasing power parity.

- Johns Hopkins Medicine, 2023: The Hidden Risks of Hearing Loss

- World Health Organization, EuroTrak, MarkeTrak, Amplifon data 2018 (markets where Amplifon is present)

- US Food and Drug Administration. 2022: FDA Finalizes Historic Rule Enabling Access to Over-the-Counter Hearing Aids for Millions of Americans

- National Eye Institute, found on website 2023: Causes of Cataracts

- Harwood, R. H. et al., 2005: Falls and health status in elderly women following first eye cataract surgery: A randomised controlled trial, Ophthalmology. Meuleners, L. B. and Fraser, M. L. et al, 2014: The impact of first- and second-eye cataract surgery on injurious falls that require hospitalisation: a whole-population study, Age Ageing. Tseng, V. L. and Yu, F. et al, 2012: Risk of fractures following cataract surgery in medicare beneficiaries, JAMA

- World Economic Forum, 2023: Charted: How life expectancy is changing around the world

- Global Self-Care Federation, 2022: The Global Social and Economic Value of Self-Care.

- National Institute for Health and Care Excellence, from website in 2023: Quality-adjusted Life Years (QALYs): A measure of the state of health of a person or group in which the benefits, in terms of length of life, are adjusted to reflect the quality of life. One quality-adjusted life year (QALY) is equal to 1 year of life in perfect health. QALYs are calculated by estimating the years of life remaining for a patient following a particular treatment or intervention and weighting each year with a quality-of-life score (on a 0 to 1 scale). It is often measured in terms of the person’s ability to carry out the activities of daily life, and freedom from pain and mental disturbance.

- Consumer Healthcare Products Association and Information Resources, Inc., 2022: 2022 Over-The-Counter (OTC) Value Study

- Microsoft, 2022: Haleon harnesses Microsoft’s Seeing AI technology to make health product information more accessible for people who are blind or have low vision

- Haleon, 2023: ESG Reporting Hub

- Sesso, H. and Rist, P., et al, 2022: Multivitamins in the prevention of cancer and cardiovascular disease: the COcoa Supplement and Multivitamin Outcomes Study (COSMOS) randomized clinical trial, The American Journal of Clinical Nutrition

- Cheng, B.H. and Li, Y.N., 2023: To Improve Your Work Performance, Get Some Exercise,Harvard Business Review

- Runrepeat.com, 2021: 200+ Gym Industry Statistics 2021 (Global Analysis)

- Statista, 2023: Number of memberships to fitness/health clubs in the US from 2000-2019

- Schomer, S., 14 Jan 2020: #7 on the Franchise 500: Planet Fitness Knows You Don’t Want to Go to the Gym, Entrepreneur

- Sophia, Deborah M., 2023: Fitness chains add financial muscle as more Americans hit the gym, Reuters News

- Planet Fitness, 2023

- Planet Fitness, 2023

- Inflation has hit hospital care harder than physician care and prescription drugs, which themselves can be costly enough to make consumers seek out other options. See Rakshit, S., et al., July 2023: How Does Medical Inflation Compare to Inflation in the Rest of the Economy? KFF

- McKinsey, 2022: Future of Wellness Survey

The specific securities identified and described are for informational purposes only and do not represent recommendations.

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States