As we approach the second anniversary of the Sustainable Finance Disclosure Regulation’s (SFDR) implementation in the EU, regulators in other key financial markets are mulling over the detail of their own proposed sustainability disclosure regimes.

We fully support efforts by regulators to improve the transparency and disclosure of sustainability metrics. More decision-useful information will help investors to better understand the risks and opportunities arising from the transition to a more sustainable economy.

There is a real and present danger that the opportunity for alignment between different regimes could be missed, however, sowing the seeds for unnecessary confusion and complexity. This cannot be in the interests of the end investors that regulators are trying to protect from the risks posed by mis-selling and greenwashing.

Last August we published our response to the US Securities and Exchange Commission’s (SEC) proposed rules on ESG disclosures and fund names. We now urge the UK’s Financial Conduct Authority (FCA) to revisit its draft Sustainability Disclosure Requirements (SDR) which, with a few important changes, could better achieve their objectives and align more closely with the international regulatory landscape.

A recipe for confusion and complexity

In our response to the FCA’s consultation this January, we articulated our conviction that the UK sustainability disclosure regime should be as close as practically possible to its EU and US counterparts.

Our concern is that low levels of alignment between the SDR framework and the existing SFDR regime and proposed US regime will pose significant challenges for advisors with clients across multiple jurisdictions. As things currently stand, different classifications and labels would be given by each regulator to investment products based on the same underlying portfolios.

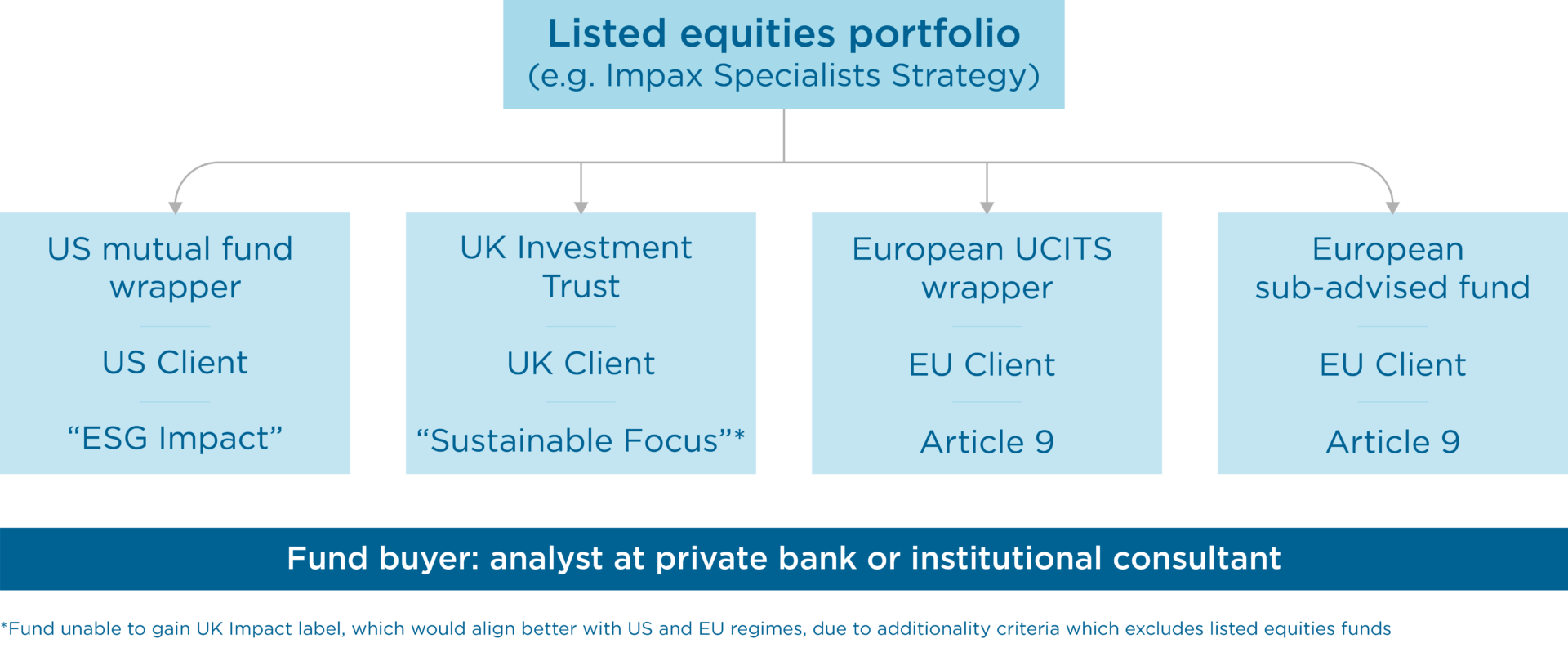

An illustrative example of an Impax strategy distributed across the EU, UK and US, demonstrates how fund buyers could see three different sustainability-related labels for the same product. This unnecessary complexity can only add confusion for advisers and investors.

Avoiding unintended consequences

Amendments to the FCA’s proposed labels for sustainable investment products could better align the UK with the de facto EU labelling regime and support advisers, their clients and the asset management industry.

First, restrictive conditions around use of the ‘Sustainable Impact’ label should be reconsidered. Under current proposals, most Article 9’ strategies (under SFDR) would not qualify given the prerequisite for impact ‘additionality’. This could have the unintended consequence of limiting the range of liquid investment products available to investors, rather than the intended elimination of greenwashing. Given high demand for positive impact investment products, we do not believe that it is consumers’ best interests to effectively preclude listed equities funds from this category.

Second, we recommend setting tiered thresholds for portfolio alignment with sustainability definitions to allow consumers to clearly differentiate between products. Current proposals for a ‘non-hierarchical’ classification system are, in our view, undesirable and unrealistic in that consumers will treat them as a hierarchy. In line with existing EU and proposed US standards, a higher purity level should be set for funds using the ‘Sustainable Impact’ label and a lower one for ‘Sustainable Focus’ funds.

Third, unless the regime is more closely aligned with other markets, the FCA should limit its scope to UK funds. Applying the regime to UCITS that are already categorised under European conventions would contribute further to investor confusion and to the reporting burden placed upon international asset managers. We encourage the FCA to be mindful of growing regulatory burdens and to allow existing reporting, such as TCFD reports and the UK Stewardship Code (in the case of UK companies), to be used in its regime where appropriate.

The FCA’s lack of alignment with emerging international norms will do little, in our opinion, to realise its aspiration for the UK to be “a trusted centre for sustainable investment and … at the forefront of sustainable investing internationally”, nor to increase capital flows into sustainable activities.

Tackling greenwashing and thereby helping retail investors navigate an increasing complex investment product landscape is a goal we fully support. However well intended, though, regulation must reflect reality.

Being out of step with emerging global norms is unlikely to support the UK government’s objectives to attract foreign investment and reinforce the UK’s position as a global centre for sustainable finance. Aligning with other disclosure regimes will also better enable the UK finance sector to demonstrate its commitment to financing the transition to a sustainable economy – something Impax has been doing for more than two decades.

United States

United States