Since the 1970s, the pressures placed on the planet have exceeded its capacity to regenerate. The over-exploitation of land and sea is such that an estimated 1.75 Earths would be needed to supply the natural resources and ecological services we use.1

This ecological overshoot is a function not only of the world’s rising population, which is projected to hit 8 billion by 2023, but of a wasteful economic model that depends on unsustainable extraction of finite natural resources.2

To address pressing environmental issues such as biodiversity loss and plastic pollution, it is vital that we shift away from the linear “take, make and waste” model. We must move towards a more circular economy in which growth is fully decoupled from extractive, wasteful processes. As well as maximizing recycling and recovery rates, this involves keeping products and materials in use for as long as possible and, ideally, preventing waste through better design and new business models.

A crucial contribution to tackling climate change can also be made. The Ellen MacArthur Foundation estimates that transitioning to a circular economy could align hard-to-abate sectors with net-zero goals and cut around one-fifth of projected greenhouse gas emissions by 2050.

Making the most from existing resources is central to this transformation. Sectors such as packaging can significantly contribute to greater circularity. By extending the shelf life of food, improved packaging can reduce food waste and therefore help curtail agriculture-related deforestation, biodiversity loss and emissions. Technological solutions that help eliminate wasteful practices in resource-intensive sectors like construction, such as computer-aided design software, can also materially advance resource efficiency.

The emerging sharing economy, in which a growing breadth of products are formally rented out, meanwhile offers great potential for maximizing the productive use of the global asset base.

Disruptive, but not always sustainable

Business models for sharing the use of goods, as alternatives to private ownership, are not in themselves new. Today, though, innovative sharing models are disrupting a range of sectors. The most prominent examples are perhaps Airbnb’s challenge to the hospitality industry and the impact of ride-hailing firms such as Uber and Didi on the personal mobility market.

Critically though, models like these are more focused on consumer convenience than sustainability goals, and in many cases they create significant negative externalities, especially for local communities affected by inflated rental prices or exacerbated traffic problems. Most also remain loss-making and have yet to demonstrate their economic value. We remain unconvinced by the investment proposition or sustainability credentials of these disruptive consumer-focused businesses.

Successful, profitable business models aligned with a more circular economy have emerged in certain niches, however. One example is in uniform rental services offered by the likes of US-based Cintas. Providing companies with clean and repaired uniforms for their employees ensures clothes are re-used efficiently, reducing waste in textile production and achieving vast economies of scale in industrial laundry plants. Cintas estimates that its processes use 46% less water and 41% less energy, on average, than home laundry.3

This illustrates the resource and economic efficiencies that rental models can deliver both in the production of goods and their ongoing management. One area of the global economy where we perceive opportunities for investors and for advancing circularity is in equipment rental.

Large equipment, vast efficiencies

At face value, it might seem counterintuitive to share the conviction that companies leasing out polluting plant machinery play an important role in the transition to a more sustainable economy. But it is precisely because the likes of diggers and telehandlers are so capital- and resource-intensive that rental models can deliver large sustainability benefits.

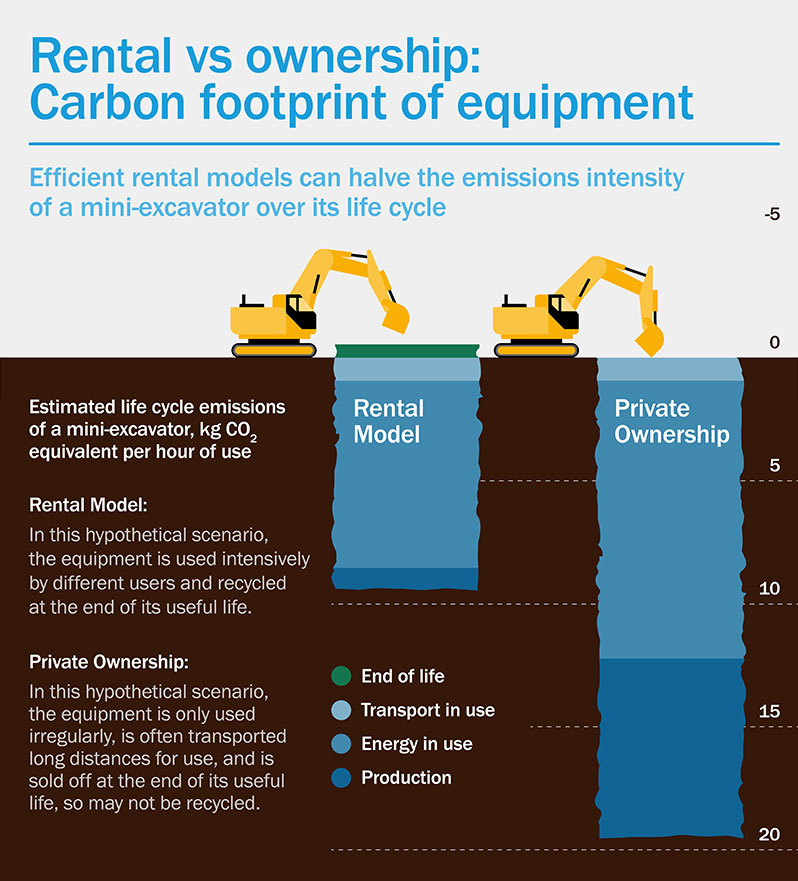

Lifecycle analysis of the carbon emissions of industrial equipment indicates that rental models can reduce overall emissions by between 30% and 50%.4

Rental models can reduce emissions in three ways. First, rental companies can minimize the time when plants sit idle by offering access to equipment that is appropriate to the task, and only for when it is needed. Maximizing the utility of equipment means the overall asset base can be smaller, so reducing emissions generated in their production (which form a material proportion of lifecycle emissions).

Second, professional rental companies can achieve enhanced operational efficiencies in a few ways. Dense branch networks allow equipment to be rented locally, reducing travel to projects, and investment in telematics can deliver data-led optimization of operations. Properly maintaining equipment will also minimize downtime and operational emissions. It also extends the working lives of assets, thereby delaying the need for resource-intensive replacements.

Third, large industrial rental businesses, unlike their smaller competitors, have enough capital to invest in innovative new technologies. They will therefore be crucial to scaling up lower emission products and providing affordable access to them over time.

Ashtead, which operates under the Sunbelt brand in the US, the UK and Canada, is a global leader in equipment rental. It boasts an 11% share of the US$55 billion per year US construction and industrial equipment rental market. Just over one-fifth of the company’s fleet is now powered by alternative fuels, including batteries, electric and solar. Its second-largest rental category, by volume, is electric-powered scissor lifts.6

In addition to electrified plant, we perceive particular opportunities in the rental of specialist equipment that companies would only need for certain projects, and for whom buying them outright would not make sense. Large rental companies can typically offer a wider range of specialist equipment than smaller competitors.

More generally, we expect the secular trends that have powered the industry’s growth to continue. Renting equipment offers companies affordable access to the latest, most efficient technology and ensures compliance with safety and environmental regulations. By shifting costs from capital expenditure to operational expenditure, it can also confer cash flow and tax advantages.

There remains road left to run in the penetration of rental models, even in relatively advanced markets. Although rental penetration in the US construction and industrial equipment market has risen from 35% in 2005 to 55% in 2021, for instance, Ashtead projects this could rise to “well over 60%.”7

Given its potential to improve resource efficiency across swathes of the modern economy, including resource-intensive sectors like construction, we believe that equipment rental can play a material role in building the foundations for a sustainable, circular model that is aligned with global net zero.

1 Global Footprint Network, 2022: National Footprint and Biocapacity Accounts

2 United Nations, 2019: World Population Prospects 2019

3 Cintas, 2021: ESG Report 2021

4 European Rental Association and Climate Neutral Group, 2019: Carbon Footprint of Construction Equipment

5 For full details of the calculations underpinning these scenarios, refer to the research report, Carbon Footprint of Construction Equipment

6 Ashtead, 2021: Responsible Business Report

7 Ashtead, 2021: Strategic Report

United States

United States