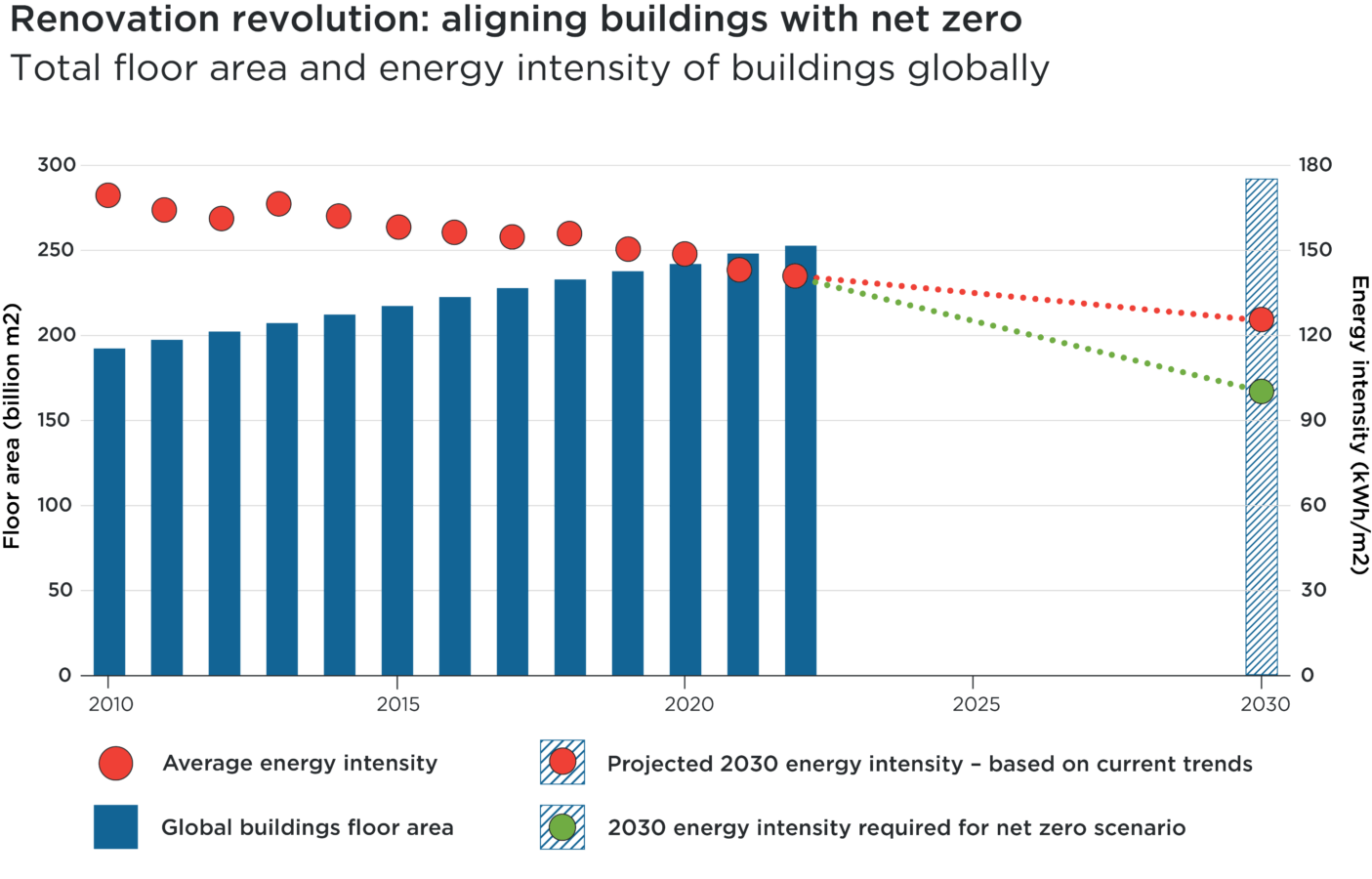

Chart Subtitle: Total floor area and energy intensity of buildings globally

Overview

The chart above shows the increasing floor area of all buildings globally, from 2010 to 2022, and projects a number for 2030. It also shows an average energy intensity number for each of those years in kilowatt-hour per square meter, with two projected numbers for 2030, one that shows where this rate needs to land to achieve net-zero goals (shown in green), and another higher number that shows where the number will be if business continues as usual. Please see the tables below for the data:

| Year | Global Floor Area |

|---|---|

| 2010 | 192.4 |

| 2011 | 197.3 |

| 2012 | 202.2 |

| 2013 | 207.2 |

| 2014 | 212.2 |

| 2015 | 217.3 |

| 2016 | 222.5 |

| 2017 | 227.8 |

| 2018 | 232.9 |

| 2019 | 237.7 |

| 2020 | 242 |

| 2021 | 248.1 |

| 2022 | 252.7 |

| 2030 | 290.9 |

| Year | Energy Intensity |

|---|---|

| 2010 | 168.5 |

| 2011 | 163.2 |

| 2012 | 159.6 |

| 2013 | 160.3 |

| 2014 | 156.3 |

| 2015 | 153.8 |

| 2016 | 152.5 |

| 2017 | 151.8 |

| 2018 | 152.7 |

| 2019 | 149.7 |

| 2020 | 146.1 |

| 2021 | 146.6 |

| 2022 | 145.1 |

Projected 2030 average energy intensity: 129.5

Energy intensity required to achieve net-zero goals: 96.2

Source: IEA, 2023: Global floor area and buildings energy intensity in the Net Zero Scenario, 2010-2030.

Buildings generate 40% of global CO2 emissions and consume over 30% of all energy.1 Making offices and homes more energy efficient is therefore key to achieving climate targets, especially as the built environment continues to expand.

Headway has been made: between 2010 and 2022, the average energy intensity of buildings globally fell by 14%. Regulation has helped drive progress as energy efficiency rules apply to a rising proportion of commercial and residential real estate. New buildings are built to higher efficiency standards mandated by governments and tenants.

For the world’s buildings to align with net-zero scenarios, however, energy efficiency improvements need to accelerate. Retrofitting existing buildings – which consume nearly 55% of global electricity and will often remain in use for decades to come – with new technologies will be pivotal to progress.2 For example, the Environmental Protection Agency estimates that buildings in the US waste approximately 30% of the energy they pull from the grid.3

The likes of lighting and heating, ventilation and air conditioning (HVAC) systems are only replaced every 15-plus years, but newer systems can drive significant CO2 emissions reductions – and cost savings – especially in regions with very cold or hot climates.4

‘Smart buildings’ software can help optimise these systems by using timely data on energy consumption and trends that enable building owners to monitor and reduce usage. In some cases, sensors track usage more accurately across multiple systems. Artificial intelligence-enabled software can help identify patterns and areas of waste, allowing property managers to identify opportunities for saving energy – and money.5

LED lights, each of which is uniquely trackable, provide one example of how buildings can be made ‘smarter’. When connected to the cloud, LED lights – which are themselves more efficient than alternatives – can be managed to minimise energy consumption. With half of lighting in the US still using old technology, it is estimated that switching it to LED systems could generate annual savings of US$28bn.6

For landlords and tenants, smart systems can deliver significant financial savings and help insulate them from volatile energy prices. Indeed, the renovation revolution is well underway: in 2022, property owners and managers spent roughly US$73bn on smart buildings software and services worldwide, and that market is projected to grow by nearly 16% a year to more than US$303bn by 2032.7

The scale of opportunity is therefore clear for companies that can help unlock the potential for vast efficiency gains, and better align the global building stock with net-zero targets.

1Schneider Electric, 2022: The new energy landscape: Four ways digitization is creating greener, more sustainable buildings

2UN Environmental Programme, 2020: The 2020 Global Status Report for Buildings and Construction

3Environmental Protection Agency, 2023: Local Topics – Energy Efficiency in Non-Governmental Buildings

4IEA, 2022: Renovation of near 20% of existing building stock to zero-carbon-ready by 2030 is ambitious but necessary

5Spacewell Energy, a Nemetschek Group Company, 2023: Powering Efficiency: Effective Energy Management in Facilities

6Verhaar, H., 2023: Climate Hub, The New Industrial Revolution Building the future: Unleashing the renovation revolution

7Globe Newswire, 2023: Smart Buildings Market anticipated to surpass USD 304.3 Billion by 2032, with a sustained CAGR of 15.8%

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States