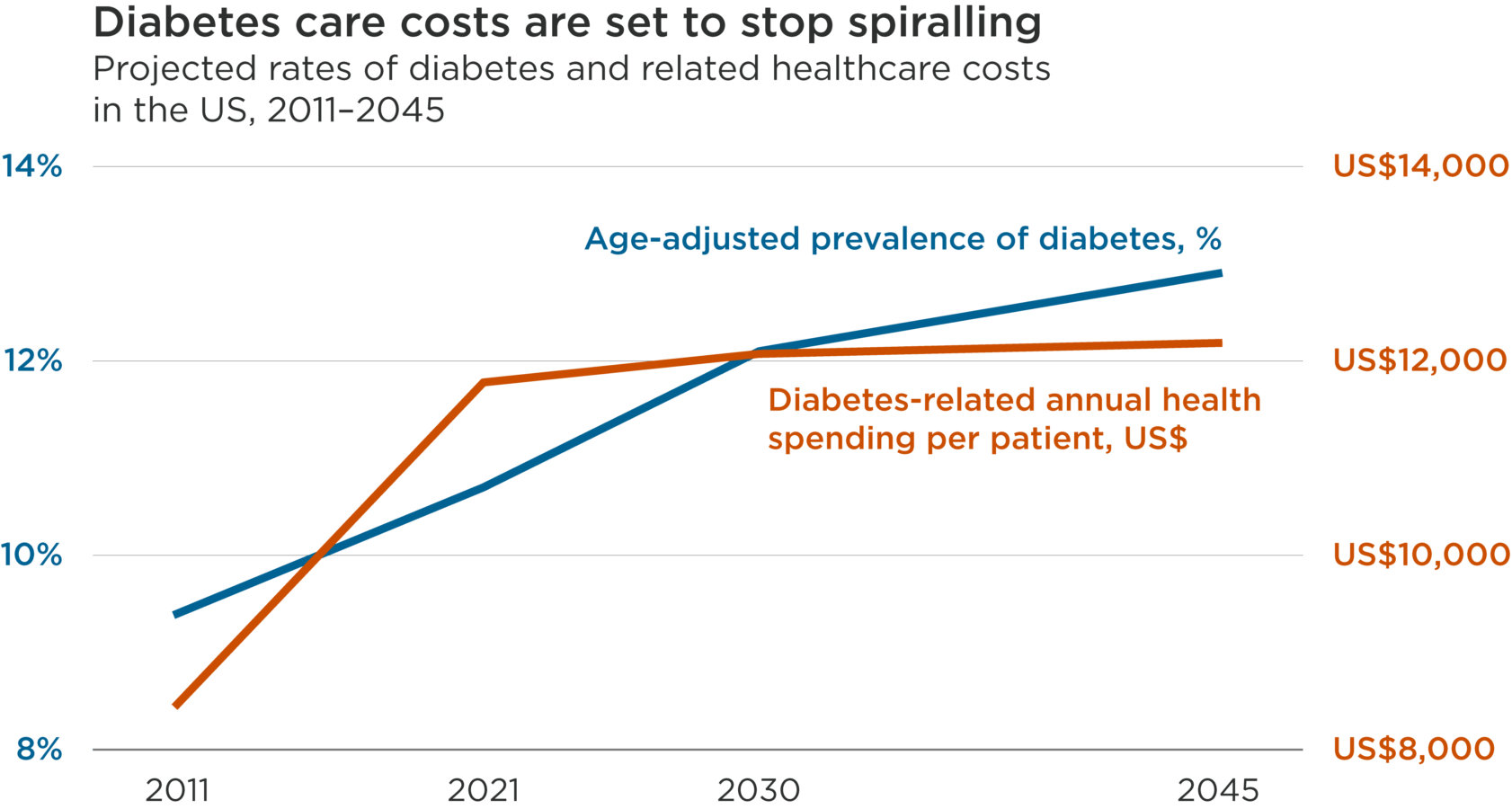

This line chart contrasts the rising prevalence of diabetes in the US population and the falling cost of treating it, from 2011 projected through 2045.

The age-adjusted comparative prevalence of diabetes in 2011 was 9.4%, and it is projected to grow to 12.9% by 2045.

The cost-per-case of diabetes in 2011 was US$8,468, and grew to US$11,779 in 2021, but is projected grow less quickly in the future, reaching US$12,073 in 2030 and US$12,184 in 2045.

Values

Numerical values presented on the image:

Change, 2011 to 2045

| 2011 | 2021 | 2030 | 2045 | |

|---|---|---|---|---|

| Diabetes-related health expenditure per person, USD | 8,468 | 11,779 | 12,073 | 12,185 |

| Age-adjusted comparative prevalence of diabetes, % | 9.4 | 10.7 | 12.1 | 12.9 |

Presentation

This line chart contrasts the rising prevalence of diabetes in the US population and the falling cost of treating it, from 2011 through 2045.

Source: International Diabetes Foundation, 2021: IDF Diabetes Atlas

Rising healthcare costs consistently outpace inflation across richer economies.1 Demographic and consumption trends have combined to drive up rates of chronic diseases, placing major health and financial burdens on society.

More than half a billion people worldwide now suffer from diabetes, one of the most prevalent chronic conditions. In the US – by far the world’s largest healthcare market by value – diabetes-related health expenditure reached US$380bn in 2021, about 9% of total healthcare spending.2 While changes in diet and exercise can help lower blood sugar, medications help many people manage diabetes effectively. These treatments can stop working under certain conditions, however, leading to last-resort insulin prescriptions.3

Encouragingly, the trend of spiralling costs relating to diabetes management looks set to be broken by three factors.

First, healthcare innovation. There are new medications that better manage blood sugar levels and have profound health benefits such as lowering cardiovascular risk.4 Additionally, US regulators designated insulin a biologic in 2020, which creates a path to market for less costly biosimilar and interchangeable treatments that require fewer regulatory approvals than pharmaceuticals.5,6

Second, efficiencies enabled by technology advances and software. Innovative software is helping hospitals to provide improved care more efficiently. In one Texas children’s hospital that used data analytics for diabetes patients with complications, 19% more patients received insulin within an hour and average times in hospital fell by 44%.7 This innovation is also happening at the patient level. Continuous glucose monitors have been shown to reduce the health care costs of Type 2 Diabetics.8

Third, cheaper insulin. The largest insulin producers in the US promised to lower prices this year as a result of newly aligned incentives and competition.9 The US government has also intervened: the amount that Medicare patients pay for insulin is now capped at US$35 per month.10 Uninsured diabetics can still pay list prices of up to US$300 per month, however.11

As the disease continues to become more common – in the US and elsewhere – over the next couple of decades, solutions that help break the inflationary cycle of diabetes treatment meet a growing need to deliver more equitable access to healthcare. By putting downward pressure on costs, innovations in treatment – from biosimilars to hospital software – can improve patient outcomes and contribute to the transition to a more inclusive and sustainable economy.

1OECD, 2023: Healthcare financing in times of high inflation

2International Diabetes Federation, 2021: IDF Diabetes Atlas

3About 5% to 10% of people with Type 2 diabetes stop responding to their medication each year. This can be caused by weight gain, changes in diet or activity level, or a recent illness. Other medications like steroids, antibiotics and antidepressants can also raise blood sugar. Lower pancreatic function can also cause less insulin to be produced, thereby allowing blood sugar levels to rise. See:

-Healthline, 21 June 2022: Steps to Take If Your Oral Diabetes Medication Stops Working

-Wexler, D., 28 July 2023: Management of persistent hyperglycemia in type 2 diabetes mellitus

4HealthCentral, 10 March 2023: New Diabetes Drugs: Ozempic, Mounjaro, and More

5American Diabetes Association, 2020: Insulin is Now a Biologic—What Does That Mean?

6Fierce Pharma, 2022: Lilly scores interchangeability tag for its Lantus biosimilar

7Health Catalyst, 2016: Inpatient Diabetes Care Process Team Improves Outcomes

8Norman, Gregory J. et al, 29 June 2022: Diabetes Technology & Therapeutics: Association Between Real-Time Continuous Glucose Monitor Use and Diabetes-Related Medical Costs for Patients with Type 2 Diabetes

9NPR, 18 March 2023: Two more drug companies joined Eli Lilly in lowering the cost of insulin

10The White House, 1 March 2023: Statement from President Joe Biden on Action to Lower Insulin Costs

11WUSA9, 4 May 2022: Yes, insulin costs about $10 to make but sells for nearly $300

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States