The rapid adoption of advanced driver-assistance systems (ADAS) in China is democratising an innovative technology and further enhancing the competitive edge of electric vehicles (EVs). We believe this fundamental transformation of the global car industry unlocks long-term opportunities for leaders in critical ADAS and EV technologies.

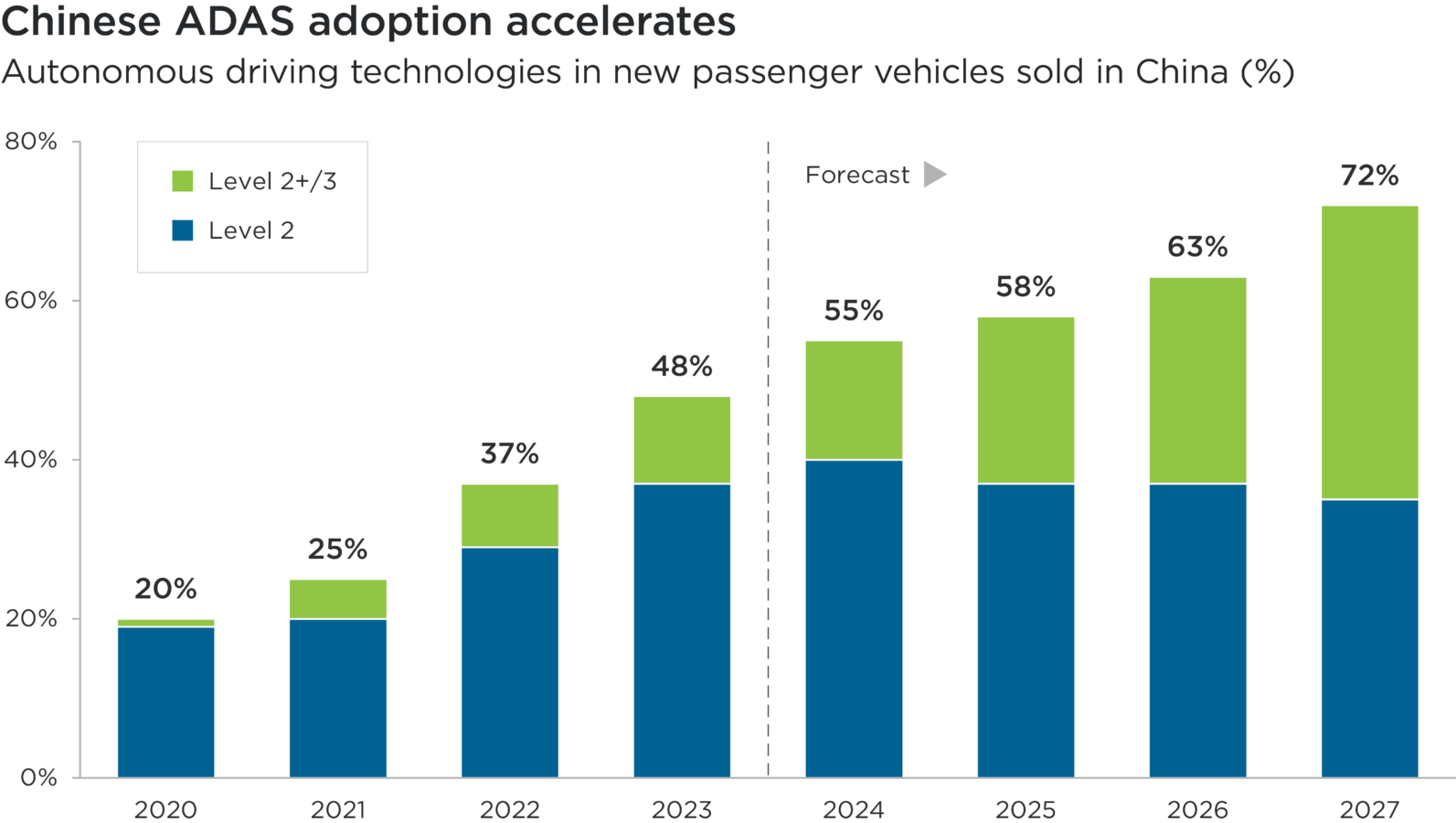

Source: Impax analysis / ResearchInChina, July 2024. Estimated data from 2024 to 2027.

Subhead: Autonomous driving technologies in new passenger vehicles sold in China (%)

Overview: This bar chart shows the percentage of new cars sold in China that have had advanced driving-assistance systems (ADAS) embedded since 2020, with forecasted data from 2024 to 2027. It shows the breakdown between Level 2 and Level 2+/3 adoption.

Overall, this chart shows that ADAS adoption in China has soared between 2020 and 2024. It also shows how more advanced Level 2+/3 technology adoption is now growing quickly and is forecast to drive sustained growth in ADAS technology integration between 2024 and 2027.

ADAS has become mass market in China

A tipping point in the adoption of autonomous driving was reached last year when, for the first time, more than half (55%) of new passenger vehicles sold in China incorporated some form of the technology. This share has more than doubled since 2021.1

Level 2 (L2) automation technologies, which dominate today, support drivers and make the driving experience more comfortable.2 Common features include steering support, such as lane centring, and brake support, like adaptive cruise control.

It is forecast that Level 2-plus (L2+) technologies – offering more advanced driver support features such as automatic lane changing – and Level 3 (L3) technologies – enabling autonomous driving under certain conditions, like highways and traffic jams – will now be rapidly adopted and installed within more than one-in-three new Chinese cars by 2027.3

BYD, the world’s largest EV manufacturer by volume, has more than 4.4mn vehicles on the road equipped with L2 technologies.4 Earlier in 2025, the China-listed company announced plans to embed L2+ features as standard within its mass market models, which carry list prices below RMB 200,000 (US$27,500).5 Its DiPilot system offers more advanced highway autopilot capabilities, including autonomous lane changes, and memory-based navigation for high-frequency routes, including automatic stop-go at traffic lights.6

Reinvigorating the global EV market

Global EV sales rose by one-quarter to 17.1mn in 2024.7 China, by far the world’s largest EV market with 11.0mn sales, accounted for 92% of this growth, though.8 Sales growth was sluggish in North America and even slightly negative in Europe as consumers continue to debate the pros and cons of switching to new energy vehicles.

However, we believe the integration of advanced driver support and autonomous driving features, increasingly as standard, has the potential to revive the consumer appeal of EVs outside of China. According to a McKinsey survey, one-quarter of car buyers would very likely choose an advanced ADAS feature when purchasing their next vehicle.9

Alongside an enhanced driver experience, safety and insurance costs are also supportive factors. One study estimates that ADAS could reduce road accidents in the UK by 24%, for example.10 Lower accident risks should, in theory, translate into lower insurance premiums.

Opportunities for enabling technologies

Accelerated adoption of more advanced ADAS in new EVs would clearly be positive for dominant original equipment manufacturers (OEMs) like BYD, the market leader in China for both battery EVs (18% market share) and plug-in hybrid EVs (56%).11 The largest OEMs have greater resources to invest in innovation – BYD boasts more than 5,500 engineers focused on ADAS alone – and can better spread the costs of developing ADAS technologies over larger volumes.12

The mass market adoption of ADAS also supports structural long-term growth for suppliers of critical hardware and software to OEMs.

EV batteries are now relatively commoditised, but battery-makers are differentiated by their manufacturing expertise and efficiency. The largest, with a 38% share of the global EV battery market, is Contemporary Amperex Technology (CATL).13 The China-listed company’s well-established partnerships with OEMs and technological leadership make it well positioned to grow in line with end markets, in our view, especially amid regulator and consumer concerns about battery safety and reliability.

Other prospective beneficiaries of the long-term electrification trend include leading suppliers of electrical architecture to OEMs. Among these is Aptiv, a US-listed supplier of EV electrical and connectivity systems and ADAS software.

Keeping US tariffs in perspective

The recent introduction of 25% tariffs on imported vehicles – and on non-US components within those assembled domestically – threatens to undermine EV sales growth in the US. But the world’s largest economy accounts for barely 8% of global EV sales and policy change, including the removal of tax credits for EV buyers, had been signposted before November’s elections.14

Even excluding the US, global EV sales are projected to double by 2030.15 Within this trend towards the electrification of vehicles, and reinforcing it, is the accelerating integration of advanced ADAS technologies by car manufacturers.

China has set the pace of innovation and adoption, putting Chinese OEMs like BYD at the vanguard of this technological revolution. As European and other Asian OEMs look to catch up, leading suppliers of ADAS hardware and software – from China and elsewhere – are well-positioned to participate in the dual shift towards autonomous and electrified driving.

1 Impax analysis / ResearchInChina, July 2024

2 Levels defined by the Society of Automotive Engineers

3 Impax analysis / ResearchInChina, July 2024

4 BYD, 10 February 2025

5 As at 7 April 2025

6 BYD, February 2025: BYD Reveals DiPilot Advanced Intelligent Driving Assistance System

7 Rho Motion, January 2025: Over 17 million EVs sold in 2024 – Record Year

8 Impax analysis based on figures from Rho Motion

9 McKinsey, 2023: Autonomous driving’s future: Convenient and connected

10 Masello, L. et al, 2022: On the road safety benefits of advanced driver assistance systems in different driving contexts. Transportation Research Interdisciplinary Perspectives

11 Automobility data for January to February 2025, cited by White, E. & Li, G., 6 April 2025. The relentless innovation fuelling China’s ‘brutal’ car wars. Financial Times

12 BYD, February 2025

13 SNE Research, February 2025. Figures for 2024.

14 Cox Automotive / Rho Motion, January 2025

15 IEA, 2024: Global EV Outlook 2024

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States