Overcoming barriers to opportunity and ensuring more people can gain skills and fulfil their aspirations, will be key to enabling the transition to a more sustainable and inclusive society. Innovative companies focused on enhancing access to quality education, work and childcare can help break down structural hurdles to inclusion and tap into growing long-term demand for their services.

To unlock society’s potential and help avert the prospect of a global talent shortage that could stunt potential global economic output by 6.6% by 2030, three key challenges must be addressed.1

First, access to education must be democratised to enrich human capital and develop the skills needed for productive work. Second, matchmaking between recruiting companies and those looking for work must become more transparent to tap wider talent tools and reinforce meritocracy. Third, the barriers to returning to work created by childcare challenges must be addressed to enable parents of both genders to pursue career opportunities.

Innovative solutions to these three challenges are emerging, enabled in the first two cases by artificial intelligence (AI) and intelligent use of data. As digital connectivity pervades more layers of global society, it widens access to internet-based education and recruitment services. We believe companies that can successfully leverage these trends can tap into long-term opportunities while broadening access. Meanwhile, the growing concentration of child-rearing couples in urban areas provides a large market for innovative childcare solutions that support parents in maintaining a healthy work-life balance.

We believe that the growth opportunities from these long-term secular trends shaping society can be underestimated by the market, and that companies whose services address these challenges can thrive while enabling progress towards a more inclusive economy.

Scaling up educational opportunities

Education enables people to improve their wellbeing and contribute positively to a more sustainable global society. Yet 16% young people worldwide are excluded from education, restricting their opportunities and entrenching inequalities that often run along ethnic, gender and socioeconomic lines.2

It is encouraging that the ubiquity of smartphones has the potential to lower historic barriers to education based on background and geography, in developed and developing economies alike. It is estimated that 68% of the global population today has access to a smartphone, and so internet-based services.3

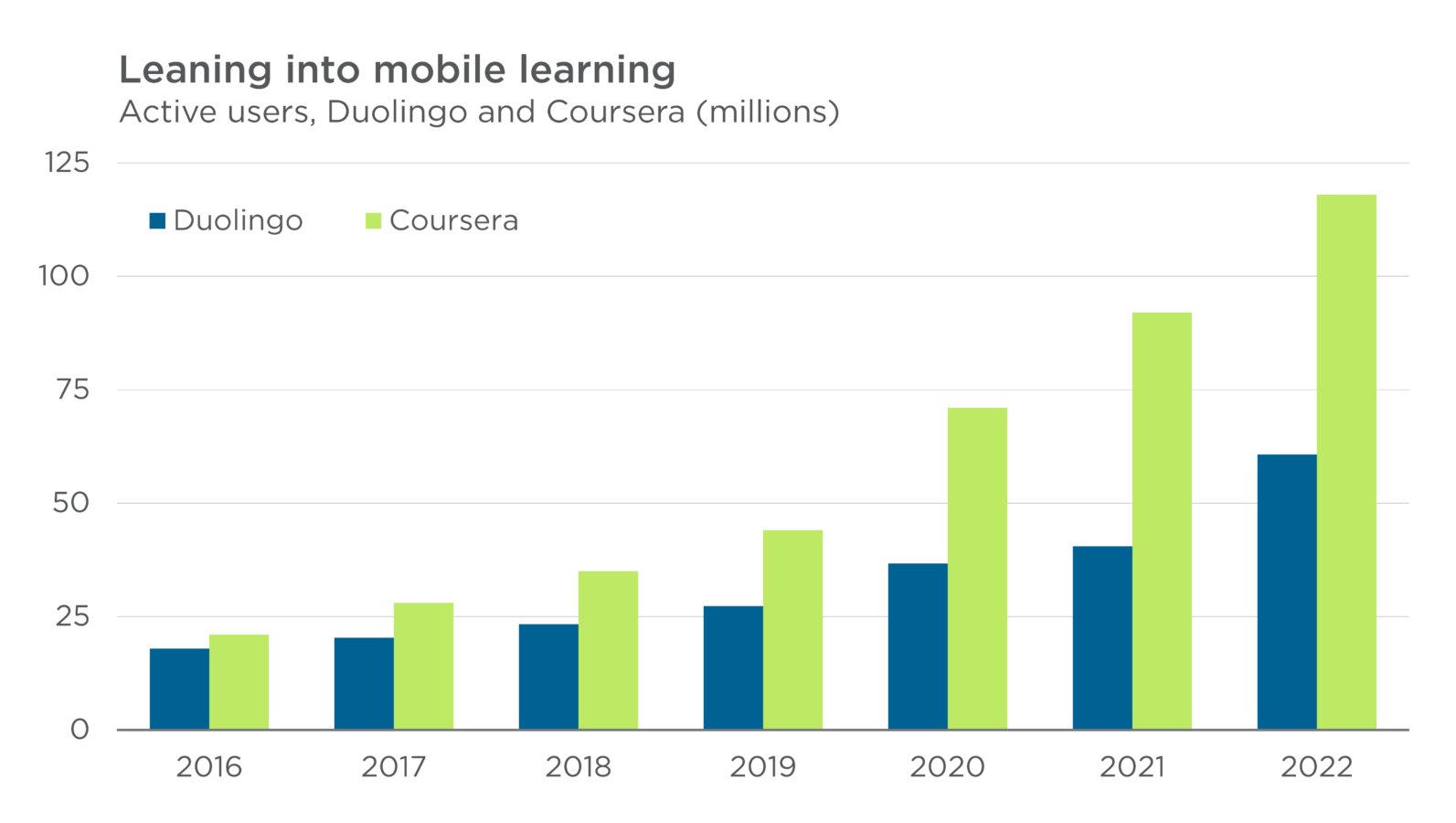

Though education remains predominantly classroom-based, remote learning technologies now reach a range of student audiences. More higher education institutions are using digital learning technologies to offer students more flexibility. Meanwhile, online platforms such as Coursera that offer ‘Moocs’ (massive open online courses) enable hundreds of millions of people to pursue their academic interests and build new skills. It is a rapidly growing area: according to one study, the value of the mobile learning market is projected to grow from approximately US$61bn in 2023 to US$184bn in 2028.4

Chart Subtitle: Active users, Duolingo and Coursera (millions)

Overview

This chart shows the millions of active users for Coursera and Duolingo at year-end, from 2016-2022.

Values

Numerical values presented on the image:

| Active Users, Duolingo and Coursera (millions) | |||||||

|---|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Duolingo | 17.9 | 20.3 | 23.3 | 27.3 | 36.7 | 40.5 | 60.7 |

| Coursera | 21 | 28 | 35 | 44 | 71 | 92 | 118 |

Source: Duolingo, 2023 and Coursera, 2023. End of year data.

Language learning is a prime example of how disruptive technologies can democratise the development of useful skills and create opportunities for innovators. Historically, only the relatively well-off could afford to pay for education in foreign languages outside of school systems, especially classes customized to gauge and support individual progress. But emerging technologies are removing these hurdles and meeting pent-up demand for affordable, remote language learning tools.

Duolingo is the market leader in the mobile language learning market, which is forecast to grow from US$7.4bn in 2022 to $US31.5bn by 2030.5 The US company offers bite-sized lessons in 43 languages worldwide, applying the principles of ‘gamification’ to engage its 500 million users. The Duolingo app, the world’s second-most downloaded educational app, is free to use.6 However, paying subscribers cut out advertisements and benefit from added features, largely enabled by artificial intelligence. Thus the billions of hours users spend on the platform drive its continuous improvement.

Improving access to employment

Digital innovation is also revolutionising hiring and application processes across sectors and regions.

Historically, uncompetitive recruitment processes have often drawn on narrow talent tools. Things have improved thanks to a combination of laws clamping down on discriminatory hiring practices and a growing understanding that better recruitment can drive better financial outcomes. It is acknowledged that diversity in the workforce can help avoid poor corporate decision-making.7

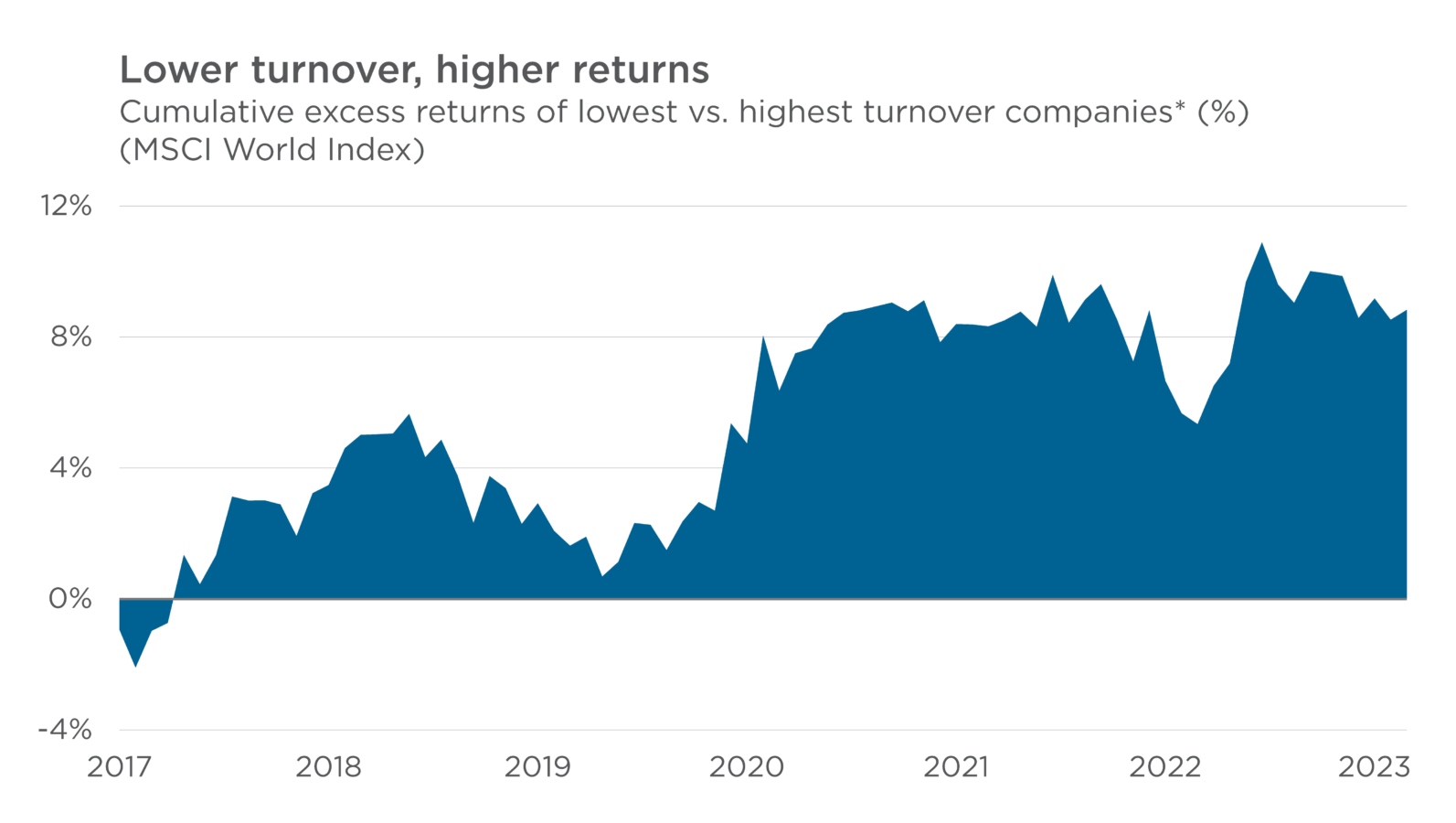

Turnover – often the result of less thoughtful hiring – is a major expense for companies, yet it is difficult for investors to price as it’s not reported in a standard or widespread way. Turnover information is available for approximately 30% of firms but varies widely – some do not distinguish between voluntary and involuntary turnover, for example.8 Among those that do report, companies with lower turnover have historically generated higher returns than those with higher turnover (see the chart below). A recent study of a large online retailer found that only one in three new hires in 2021 stayed with the firm for more than 90 days. Regretted and unregretted turnover costs totalled US$8bn, or approximately 25% of the company’s total profits.9

Chart Subtitle: Cumulative excess returns of lowest vs. highest turnover companies (%) (MSCI World Index)

Overview

This chart shows the average excess returns (among MSCI World Index companies that report turnover) of those with the lowest turnover vs. those with the highest (bottom two quartiles vs. top two quartiles), based on Impax’s analysis of FactSet data as of August 2023. The period is December 2016-August 2023.

Values

Numerical values presented on the image:

| Period | Cumulative Excess Return (%) |

|---|---|

| 12/30/2016 | -0.94 |

| 1/31/2017 | -2.09 |

| 2/28/2017 | -0.97 |

| 3/31/2017 | -0.73 |

| 4/28/2017 | 1.35 |

| 5/31/2017 | 0.44 |

| 6/30/2017 | 1.34 |

| 7/31/2017 | 3.13 |

| 8/31/2017 | 3.00 |

| 9/29/2017 | 3.01 |

| 10/31/2017 | 2.89 |

| 11/30/2017 | 1.92 |

| 12/29/2017 | 3.23 |

| 1/31/2018 | 3.48 |

| 2/28/2018 | 4.60 |

| 3/30/2018 | 5.01 |

| 4/30/2018 | 5.03 |

| 5/31/2018 | 5.05 |

| 6/29/2018 | 5.65 |

| 7/31/2018 | 4.32 |

| 8/31/2018 | 4.86 |

| 9/28/2018 | 3.78 |

| 10/31/2018 | 2.32 |

| 11/30/2018 | 3.75 |

| 12/31/2018 | 3.38 |

| 1/31/2019 | 2.29 |

| 2/28/2019 | 2.92 |

| 3/29/2019 | 2.08 |

| 4/30/2019 | 1.63 |

| 5/31/2019 | 1.90 |

| 6/28/2019 | 0.68 |

| 7/31/2019 | 1.13 |

| 8/30/2019 | 2.32 |

| 9/30/2019 | 2.26 |

| 10/31/2019 | 1.49 |

| 11/29/2019 | 2.37 |

| 12/31/2019 | 2.96 |

| 1/31/2020 | 2.69 |

| 2/28/2020 | 5.36 |

| 3/31/2020 | 4.75 |

| 4/30/2020 | 8.04 |

| 5/29/2020 | 6.35 |

| 6/30/2020 | 7.50 |

| 7/31/2020 | 7.65 |

| 8/31/2020 | 8.38 |

| 9/30/2020 | 8.74 |

| 10/30/2020 | 8.81 |

| 11/30/2020 | 8.93 |

| 12/31/2020 | 9.05 |

| 1/29/2021 | 8.78 |

| 2/26/2021 | 9.12 |

| 3/31/2021 | 7.83 |

| 4/30/2021 | 8.39 |

| 5/31/2021 | 8.38 |

| 6/30/2021 | 8.32 |

| 7/30/2021 | 8.50 |

| 8/31/2021 | 8.77 |

| 9/30/2021 | 8.31 |

| 10/29/2021 | 9.90 |

| 11/30/2021 | 8.43 |

| 12/31/2021 | 9.13 |

| 1/31/2022 | 9.61 |

| 2/28/2022 | 8.52 |

| 3/31/2022 | 7.25 |

| 4/29/2022 | 8.81 |

| 5/31/2022 | 6.65 |

| 6/30/2022 | 5.67 |

| 7/29/2022 | 5.34 |

| 8/31/2022 | 6.51 |

| 9/30/2022 | 7.19 |

| 10/31/2022 | 9.68 |

| 11/30/2022 | 10.89 |

| 12/30/2022 | 9.60 |

| 1/31/2023 | 9.04 |

| 2/28/2023 | 10.01 |

| 3/31/2023 | 9.94 |

| 4/28/2023 | 9.86 |

| 5/31/2023 | 8.58 |

| 6/30/2023 | 9.17 |

Source: Impax internal analysis based on FactSet data, August 2023. Period 30 December 2016 to 31 August 2023.

* ‘Lowest vs. highest turnover’ is defined as bottom two quartiles vs. top two quartiles, among MSCI World Index companies that report turnover rates.

Past performance does not guarantee future results. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. Indexes are unmanaged and not available for direct investment.

Today, online recruitment platforms are helping to match companies with candidates. While companies benefit from access to a deeper talent pool, applicants benefit from access to a wider set of opportunities. Greater transparency in the application process also serves both parties well. While companies benefit from a robust batch of suitable applicants, with consistent, relevant information for each, applicants can have access to more information about the hiring company including pay and benefits. All in all, this helps make a better informed, durable match that improves hiring efficiency, reduces potential churn and benefits both parties.

Recruit Group, which owns online job platform Indeed and Glassdoor, a website for workers to anonymously review their employers, is at the centre of the trend towards greater transparency in hiring. The integration of these sister companies’ services adds value for clients, providing the Japan-listed group with a competitive advantage. Indeed and Glassdoor make each other stronger, enabling Recruit’s advance in both markets.

Enabling a hiring environment that is both more efficient and more equitable are Recruit’s dual aims. By 2030, its target is to halve hiring times and support 30mn candidates into new roles, including those facing barriers like racial and gender discrimination, criminal records and military service histories. The company says that 3.9mn applicants facing these barriers have been hired as a result of the more transparent process it enables.10

77% of US working parents reported that having childcare support affects their productivity.

Source: Bright Horizons, 2023

Supporting working parents

Childcare is a crucial ingredient for a productive and inclusive workforce. In the US and the UK, among other economies, access to affordable, convenient childcare can determine whether it is feasible for parents to work outside the home. At a societal level, it can also narrow the persistent gender wage gap by enabling all parents to manage their careers more effectively.

Many employers today recognise the value of including childcare in benefits packages. Supporting employees with juggling the demands of parenthood helps them to concentrate on and succeed in their professional roles. This ultimately enables better recruitment, retention and professional progression. For their part, employees value childcare solutions that do not involve out-of-pocket costs. According to a recent study, 40% of parents in the US reported not having access to the childcare they need, with 41% citing cost as a barrier.11

Among the companies providing solutions for employers and parents is Bright Horizons, which runs more than 1,000 pre-school daycare centres across the US, as well as in the UK, the Netherlands and India. The US-listed company also offers convenient on-site childcare in companies’ offices, as well as emergency back-up care services for dependents of all ages. Roughly 20% of US workers are caring informally for elderly relatives, the company says.12

In the US, where publicly funded childcare is only guaranteed in a few municipalities, pandemic-era government subsidies are due to end.13,14 We believe this will support demand for Bright Horizons’ employer-paid solutions, especially in a tight labour market where employee retention is especially prized.

Connecting people with opportunities

Digital technologies are enabling high quality, personalised learning and recruitment services that connect people with the skills and opportunities they aspire to. Innovative childcare solutions meanwhile support more parents in the workforce – to the mutual benefit of employees and employers. We are encouraged by the prospects for greater equality of opportunity made possible by these trends.

The innovative companies driving these long-term trends have business models that continue to improve as more people use them, providing a runway of scalable opportunities. As these companies grow, opportunities for skilled and rewarding work can reach more of the global population than ever before.

1 Impax estimate based on a forecast of US$8.5bn in unrealised global economic output by 2030 (Korn Ferry, 2018: Future of Work – The Global Talent Crunch) and an assumption that the global economy will grow by 3% a year to 2030 from US$104.5trn in 2023 (IMF, 2023: World Economic Outlook, October 2023).

2 UNESCO, 2023: 250 million children out-of-school: What you need to know about UNESCO’s latest education data

3 Laricchia, F. 2023: Global smartphone penetration rate as share of population from 2016 to 2022

4 ReportLinker, August 2023: Mobile Learning Market Size & Share Analysis – Growth Trends & Forecasts (2023 – 2028)

5 SNS Insider, 2022: Online Language Learning Market

6 Apple app store, as at 22 September 2023

7 Impax Asset Management, 2023: The financial impact of diversity and culture

8 Impax internal analysis, based on Factset data

9 Atz, U. and Whelan, T., 2023: NYU Stern Center for Sustainable Business Sixth Annual Practice Forum

10 Recruit Holdings, 2023: FY2022 Annual Report

11 Bright Horizons, 2023: 9th Annual Modern Family Index

12 Bright Horizons, 2023

13 Fousekis, N. 2011: Demanding Child Care: Women’s Activism and the Politics of Welfare, 1940-1971

14 Burga, S., September 2023: As Pandemic-Era Childcare Funding Ends, Many Families Could Suffer. Time Magazine.

The specific securities identified and described are for informational purposes only and do not represent recommendations.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States