Over the last two decades, Impax has been a pioneer of investing in the transition to a more sustainable economy. While the foundation of this success has been built around equity investing, our US based fixed income team has over 20 years of experience in this asset class.

Over this period, our US based fixed income team have witnessed and, in some instances helped, shape important fixed income market innovations:

- In 1999 launched the first high yield bond fund focused on utilizing ESG research.

- Were an early investor in the green bond market, supporting some of the US banking sector’s first Green Bond transactions in 2010.

- Last year, led the origination of, and were the sole investor in, The World Bank’s first US dollar denominated gender-linked bond.

- Have led the development of a sustainable credit taxonomy to include debt issued by environmental markets issuers.

This month, we focus on Impax’s investment approach to the growing sustainable credit markets, particularly:

- How we believe impact bonds can improve portfolio diversification and risk management, and generate competitive returns, all while driving positive societal and environmental outcomes;

- Given the fixed income market’s expansion into new sectors and across more impact themes, how to construct diversified portfolios that combine labeled green bonds with a variety of other high-impact bonds. The resulting portfolios may better replicate the broader fixed income indexes while avoiding some of the pitfalls and idiosyncrasies of green and impact bond indexes.

- The importance of using a robust ESG research framework in fully vetting the embedded credit risks and the risk adjusted return potential of impact investments. Not all bonds are created equally!

In this article, we will cover the Impax fixed income teams’ approach and provide examples of impact investments that they have invested in, as well as some that they have avoided.

Impact investing in fixed income is growing

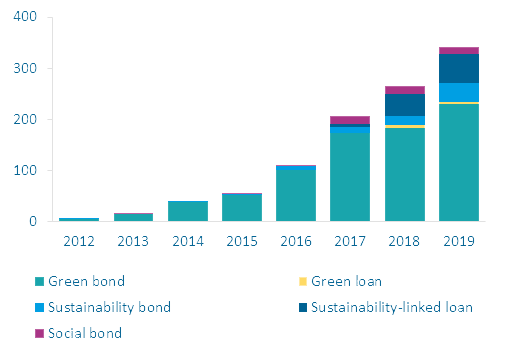

The growth of sustainable fixed income products is driven by investors’ increased interest in finding solutions that combat environmental and social challenges, including climate change and inequality. This is coupled with issuers’ desire to be identified as undertaking sustainable business activities. As such, 2019 marked the 8th consecutive year of record issuance in the sustainable bond markets,1 and 2020 is off to a flying start. While labeled green bonds continue to make up the largest part of the market, attention is shifting to a broader range of sustainability linked bonds and loans. Such non-labeled green bonds experienced the most growth in 2019 (Fig 1), fueled in part by greater adoption of the UN Sustainable Development Goals (SDGs) as a framework for understanding and defining opportunities for impact. In addition, participation by a broader range of issuer types is growing, with a full spectrum of issuers—from supranational to municipal issuers to community development banks, alongside investment grade and high yield corporates—now taking part.

Fig. 1 Global sustainable credit issuance is broadening in asset type and growing in size (US$ BN)

Casting a wider net to construct higher quality portfolios

Such consistent growth in the sustainable credit space has brought welcome developments—one of which being new opportunities to generate competitive returns and construct more diversified portfolios across a broadening range of fixed income sectors. Drawing on our fixed income team’s longstanding investment grade and high yield expertise, we can build income-oriented portfolios that not only replicate the broader fixed income universe but avoid certain pitfalls and idiosyncrasies of green and impact bond indexes.

One such example would be our approach to combining labeled green bonds with other high-impact bonds. In contrast to traditional green bond indexes which typically have very long durations and heavy sector concentrations, Impax’s approach is to combine green and high-impact bonds, such as those from corporate issuers as well as asset backed securities (ABS), to create what we believe are more diversified portfolios that can offer better fundamental risk characteristics.

Importantly, Impax’s definition of impact bonds includes more than just green bonds. We instead assess the impact potential of all fixed income securities considered for investment as this is of utmost importance and is not exclusive to green bonds. Only if the use of proceeds is aligned with one or more of the impact focus areas listed below can a bond be considered an ‘impact bond’.

Impax’s eight focus areas for classifying the positive impact bond universe

Beware of “green/impact washing”

In such a fast-growing market, all positive impact claims will not be equally reliable, and third-party opinions may not always focus on the key areas of interest to an investor. At Impax, we believe our proprietary issuer-level environmental and social factor due diligence helps us better understand where claims overshadow underlying sustainability risks: this is true of all our investments, fixed income or otherwise. For example, in recent years, Impax has avoided certain problematic investments such as in a US based utility company that, despite its certified green label and being one of the largest green bond offerings by a utility, had recurring coal ash pollution incidents, raising questions around its environmental management processes. Prudence is critical.

We have also avoided high-yield residential energy efficiency asset backed securities which were not accompanied by verification of a borrowers’ ability to repay. Our concern that such products may be offered to low-income homeowners or projects with weak energy saving credentials stood in contrast to certified green labeling from third party vendors.

Positioned to Benefit Investors and Society

Impact investing is a relatively new yet fast evolving area of the fixed income market, offering an increasingly diverse range of options available for interested investors beyond labeled ‘green’ bonds. As such, the ability to build portfolios comparable to traditional fixed income indexes with greater diversification than the more limited green bond indexes is also evolving. To do this well, shrewd analysis is critical as not all impact investments are created equally. Robust fundamental analysis can help to meaningfully assess the true level of impact generated as well as the embedded credit risks and the risk-return potential of an impact investment. Impax’s2 early entry into the sustainable credit market and ongoing engagement with potential issuers enables us to gain access to the continued growth and innovation in the impact bond market and continues to benefit both investors and society alike.

1According to research company BloombergNEF, the sustainable debt market comprises labeled bonds and loans that finance projects with green benefits, social benefits or a mixture of both.

https://about.bnef.com/blog/sustainable-debt-market-sees-record-activity-2018/

2Through Pax World Funds the US based fixed income team has over 20 years of experience in this asset class

United States

United States