Executive Summary

We share our perspective on key themes that will shape global markets in 2022 as the transition to a more sustainable economy continues

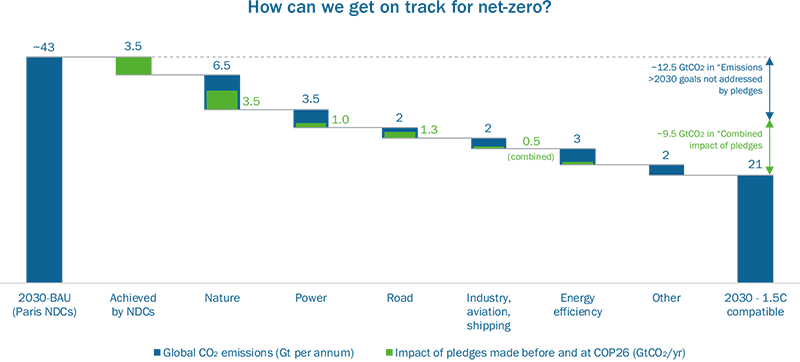

Consensus is broader than ever that urgent action is needed to keep the Paris climate goals within reach. At the landmark UN COP26 climate summit held in November, almost 200 countries agreed “to pursue efforts to limit the [global average] temperature increase to 1.5°C” and, for the first time, on the need to reduce global emissions by 45% by 2030 compared to 2010 levels.

COP26 was by no means an unmitigated success but, crucially, it laid the foundations for real progress in getting national economies on track towards net zero. The hard work begins now, starting with policymakers strengthening 2030 targets and detailing how they intend to meet their goals.

We believe that with momentum from COP26, and the growing incidence of extreme weather events, there will be sustained focus on policies that address the threats posed by climate change in 2022, and beyond. Paramount too is the related need to stem biodiversity loss.

The year ahead will also be defined by the ongoing impact of the COVID-19 pandemic and our gradual adaptation to it, including the strains on society and working life, as well as the inflationary and supply-side pressures placed on the global economy. We will be closely – and cautiously – watching developments on the battle between vaccines and new variants of the virus as they unfold.

Over the coming year, here are some of the key themes that Impax believes will shape global markets:

- An inflection point towards global net zero

- A spotlight on biodiversity

- A more interventionist China

- A global economy under strain

- A new way of working

- An added tailwind for sustainable finance

An inflection point towards global net zero

The standout success at COP26 was the emergence of large ‘coalitions of the willing’ around key issues like ending deforestation and curtailing methane emissions. Although they only go some way to delivering the emission reductions needed by 2030 (see chart below), pledges made in Glasgow represent a significant step forward.

So long as the governments, companies and investors making up these coalitions follow through on their commitments, we expect these pledges and the push for more ambitious 2030 goals to amplify investment opportunities. Products and services that improve the efficiency of buildings, industrial processes and electricity transmission, will be in growing demand. Engineering solutions that address fugitive greenhouse gas emissions will too: more than 100 countries pledged to cut methane emissions by 30% by 2030.

Whilst the language on coal in the UN COP26 decision could have been stronger, a separate agreement1 to phase down coal power generation signed by 50-plus countries and jurisdictions provides further tailwinds for renewables. Although the world’s largest coal producers China and India were absent from the deal, both have also announced ambitious renewables targets.

As they work to understand the opportunities, debt and equity investors must also look more carefully at both physical and transition climate risks. Practically, there is a clear need for more granular information and methodologies for translating environmental hazard into financial risk. Progress is needed here in 2022. Tools like the climate disclosure dashboards developed by the Climate Financial Risk Forum (with input from Impax) will help.

We believe in carbon pricing as a mechanism for capturing the environmental costs of economic activity and sending price signals to encourage investment into net-zero technologies. Carbon pricing initiatives have already been implemented in more than 40 countries, covering just over 20% of global emissions.2 EU proposals for carbon border tariffs on imported goods should encourage other jurisdictions to introduce carbon pricing regimes, rather than letting the EU capture the fiscal benefits.

While UN approval is not necessary for national governments to introduce carbon pricing, progress on international carbon markets was made at COP26 with agreement on a framework for trading emissions credits between countries and between private actors. This could possibly open the door for valuable revenue streams to start flowing towards nature-based solutions like rainforests.

A spotlight on biodiversity

Environmental degradation has brought us close to irreversible tipping points for nature, and the costs of inaction are immense. Not only does more than half of the global economy depend on nature,3 but nature-based solutions could contribute up to one-third of the emissions cuts needed by 2030.4

Building on the growing awareness of the vulnerability of nature and its links to tackling climate change, biodiversity and deforestation commitments made at COP26 shine a spotlight on agriculture and food production, which contributes 26% of global emissions as well as vast ecological damage5. We expect these issues to gain further attention from investors in 2022, not least as attention turns to the next UN biodiversity summit, COP15, hosted in China in May.

Over half of global GDP, $44 trillion, is potentially threatened by nature loss

(WEF, 2020)

The finance industry is already waking up to the risks associated with biodiversity loss. The Taskforce for Nature-Related Financial Disclosure, which Impax has supported since its inception, is creating protocols for recognising threats to biodiversity and developing metrics for measuring impacts and avoiding additional biodiversity loss. In 2022, we will continue to focus on biodiversity through our company engagements and investment process, and as part of the Natural Capital Investment Alliance, which aims to hasten the development of natural capital and biodiversity as a mainstream investment theme.

The opportunity set continues to widen. We anticipate further technological innovation in solutions delivering natural capital benefits, in areas such as water treatment and infrastructure, pollution control, and sustainable food and agriculture.

A more interventionist China

As a voracious consumer and vast producer of an array of goods, modest tweaks in Chinese domestic policy can disrupt global markets. 2021 was a year that saw forceful interventions in the economy by the Chinese government, prompting sell-offs in certain sectors.6

China’s largest technology groups lost >US$1 trillion in combined market capitalisation, February to August 2021

(Bloomberg, 2021)

The ‘common prosperity’ drive, which looks to close inequalities within the world’s second-largest economy, has led to anti-trust clampdowns in sectors prone to monopolies or oligopolies, such as fintech and the internet. The state also intervened to cut costs for people in the healthcare and education sectors, calling time on the country’s US$120 billion private tuition industry.7

These crackdowns exemplify the policy risks facing investors in China. Our sense is that these risks have not abated, especially ahead of the 20th Communist Party Congress in 2022, which will decide the leadership and the high-level policy direction for the next decade. Nonetheless, China remains committed to its carbon neutrality pledge and green development mandate to improve living standards while gaining advantages in emerging industries, such as electric vehicles (EVs) and automation. We do not therefore believe environmental solutions are at risk.

A global economy under strain

The vulnerability of global, just-in-time supply chains was highlighted in 2021. The six-day blockage of the Suez Canal – a passage for 13% of the world’s trade8 – displaced ships and goods containers, causing a significant logistical challenge since March. Disruptions to trade also came from COVID-related shutdowns, Chinese power cuts and a shortage of truck drivers.

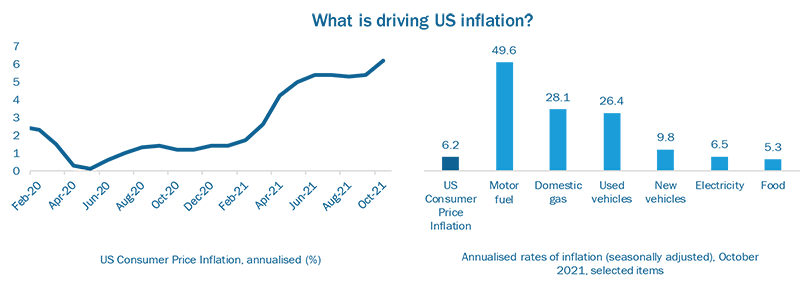

The semiconductor sector has been especially disrupted at a time when chip demand has been spurred by digitalisation efforts across sectors. Chip supply has been hampered not only by imbalanced global chains, but by the growing impact of ‘technological sovereignty’ on the flow of products and equipment, particularly between the US and China. The EV sector has been hard hit, with rapid consumer demand growth outpacing the availability of chips for carmakers. Unmet demand has pushed up prices for both new and used vehicles (see chart below).

In 2022, the global semiconductor shortage may be alleviated through both substantial investment in leading edge chip fabrication, for use in high-performance computing, and repurposing older facilities that make chips used for industrial applications, including EVs.

Recovering energy prices have been another key driver of rising consumer price inflation which, in the US, hit a three-decade high of 6.2% in October 2021.9 The extent to which the main drivers of inflation will prove transitory, and ultimately work themselves through the system, is a live debate.

In 2022, at least, inflation is likely to remain elevated, testing valuations of growth stocks. The key question is how well companies can pass on higher input prices to their customers. Broadly speaking, we expect companies in the cyclical materials, energy and industrial sectors, as well as higher-margin digital infrastructure and software companies, to weather an inflationary climate better than most.

Longer term, though, our core belief is that many of today’s inflationary pressures will abate. Pent-up demand for certain goods will ease, new capacity will be added to supply chains, and more people might be reskilled or coaxed back into the workforce. The replication of production facilities in different markets, whether to increase resilience in the face of trade disruption or due to geopolitical tensions, would also be expected to have a deflationary effect. The gradual trend towards de-globalisation would involve higher costs for businesses, indicating that the era of ‘peak margins’ might be behind us.

This should not be a scary proposition for sustainability-focused equity investors who look for resilient business models with strong pricing power. The urgency of action needed to address environmental and social challenges provides structural demand growth for companies that solve them and for those whose products and services enable them to be solved.

We believe the shares of some companies in this space are currently valued at a premium. Greater focus on climate change, in particular, has led to a re-rating of companies that can be part of the solution. The fundamentals have strengthened though, with higher projected revenue and profit growth reflecting the ramp-up in ambition to solve society’s greatest challenges.

With so much money flowing into these areas – especially in-vogue sectors like hydrogen and EVs– investors should focus on valuation discipline and long-term earnings growth, perhaps more than ever.

A new way of working

Much as the pandemic prompted companies to adapt, new ways of working forged out of necessity, and enabled by technology, are here to stay. How companies respond, in 2022 and beyond, will help define their prospects.

Company success is tied to the spirit and productivity of its workers. We believe those that empower their employees with choices on working arrangements are more likely to thrive, especially at a time when workers have more bargaining power than in most people’s memory. The ‘Great Resignation’ prompted by the pandemic – a record 3% of the US workforce quit their jobs in September 202110 – has amplified labour shortages and spurred wage inflation.

Staff retention and employee welfare will therefore remain important themes in 2022. As well as offering flexibility and support to employees, companies should not lose focus on another area brought into sharp focus by the pandemic: the importance of equality, diversity and inclusion.

Through our engagement work, we will encourage companies to commit to improvements in the areas of paid leave, flexible work arrangements, remote work arrangements and other areas key to risk management and business continuity. Transition risks facing industries that will be transformed en route to net zero call for a massive reskilling of the workforce.

An added tailwind for sustainable finance

Early in 2022, US federal agencies will begin implementing the INVEST in America Act, which became law in November. This includes US$621 billion for transport infrastructure and US$213 billion to make buildings and homes more energy efficient. Among the clear beneficiaries are industrial companies that will provide equipment to retrofit buildings, ‘sharing economy’ rental equipment companies, and EV suppliers.

However, the measures within this bill are insufficient to catalyse sustainable, inclusive long-term growth. The Biden administration’s ‘Build Back Better’ budget package goes further, with provisions that would hasten the net-zero transition by expanding incentives for clean energy and transportation, jumpstart the transition to a more sustainable grid, and boost research and development in net zero-aligned technologies. It also looks to strengthen society by expanding access to affordable healthcare and childcare, and by investing in education and housing. While the House of Representatives passed the bill in November, it remained under consideration in the Senate at the time of writing. We will be watching this closely.

Meanwhile in Europe, more funds will be dispersed in 2022 under the EU’s COVID recovery fund, strengthening demand for companies whose products and services address sustainability challenges. One-third of the €1.8 trillion from the NextGenerationEU package of loans and grants, and the EU’s seven-year budget, will finance the European Green Deal, which focuses on cleaner energy, technological innovation, the circular economy and public transport, among other areas.11

Separately, we are encouraged by both the dramatic uptick in issuance of green, social and sustainability-linked bonds by governments and corporates, and by robust demand for them. The debut €12 billion issuance of the NextGenerationEU green bond was more than 11 times oversubscribed this October.12

<5% of US defined-contribution plans are estimated to have any sustainable funds

(Morningstar, 2021)

There is growing recognition among policymakers that unlocking private capital, alongside public spending, is key to financing the sustainable transition. Important regulatory changes are now underway in the US that reflect this. In October, the Department of Labor (DOL) issued a proposed rule to empower pension scheme fiduciaries to consider environmental, social and governance (ESG) factors when making investment decisions and when voting corporate proxy ballots. Currently, it is estimated that fewer than 5% of defined-contribution plans in the US include any sustainable funds.13 Should it be adopted in 2022 as expected, the proposed DOL rule could stimulate growth for sustainable investment solutions.

No room must be left for greenwashing. In advance of the EU’s Sustainable Finance Disclosure Regulation, which requires asset managers to substantiate their sustainability-related claims, firms removed the ESG label from US$2 trillion worth of products between 2018 and 2020.14 We expect to see similar action from the US Securities and Exchange Commission in early 2022.

An acceleration of the sustainability transition

The sustainable economy will be fundamentally different from today’s. Not every company will successfully adapt, and entirely new technologies and industries will emerge. While posing challenges for investors, we believe this period of intensified creative destruction will create material long-term investment opportunities.

There are always short-term uncertainties that we will have to navigate, and 2022 will doubtless be no different. However, there is simply no time to waste in accelerating the sustainable transition. Galvanised by the pandemic, promising strides have been made in healthcare innovation and the sharing economy. Next year, we would like to see real progress towards wider recognition of the risks and opportunities associated with climate change, biodiversity loss and changing working practices.

For those of us focused on the emergence of a new economy, it feels like we are only now at the end of the beginning of our journey.

1Global Coal to Clean Power Transition Statement, 4 November 2021: https://ukcop26.org/global-coal-to-clean-power-transition-statement/

2World Bank Carbon Pricing Dashboard, 30 November 2021: Carbon Pricing Dashboard | Up-to-date overview of carbon pricing initiatives (worldbank.org)

3World Economic Forum, 2020: WEF_The_Future_Of_Nature_And_Business_2020.pdf (weforum.org)

4UN Global Compact, 2021: Nature-Based Solutions | UN Global Compact

5Our World in Data, University of Oxford, 2019, Food production is responsible for one-quarter of the world’s greenhouse gas emissions – Our World in Data

6Bloomberg data / Financial Times analysis, 7 September 2021. The combined market capitalisation of Alibaba, Tencent, Meituan and Kuaishou fell by roughly US$1 trillion between February and August 2021.

7Reuters, 17 June 2021: EXCLUSIVE China to unveil tough new rules for private tutoring sector-sources | Reuters

8World Economic Forum, 25 March 2021: What does the ship stranded in the Suez Canal mean for global trade? | World Economic Forum (weforum.org)

9U.S. Bureau of Labor Statistics, 10 November 2021: Consumer Price Index Summary – 2021 M10 Results (bls.gov)

10Economist, 27 November 2021: How to manage the Great Resignation | The Economist

11European Commission: A European Green Deal | European Commission (europa.eu)

12European Commission, October 2021: NextGenerationEU (europa.eu)

13Morningstar, 3 May 2021: Re-Envisioning ESG in 401(k) Retirement Plans | Morningstar

14Bloomberg Green, 21 October 2021: Fund Managers Brace for Correction as Greenwash Rules Go Global – Bloomberg

United States

United States